With the increasing adoption of eco-conscious lifestyles, residential solar panels have garnered considerable attention from consumers. However, it can be difficult to answer – is it better to lease or buy solar panels?

The acquisition of solar panels generally necessitates a preliminary capital outlay in the vicinity of $25,000. The precise expenditure on the system will be contingent upon its physical attributes and placement. The process of buying solar panels involves obtaining complete ownership of the system, which allows one to benefit from tax advantages and energy conservation potentially. In such a scenario, you deduct the utility rebate for installing solar panels from the cost of your system before calculating your tax credit.

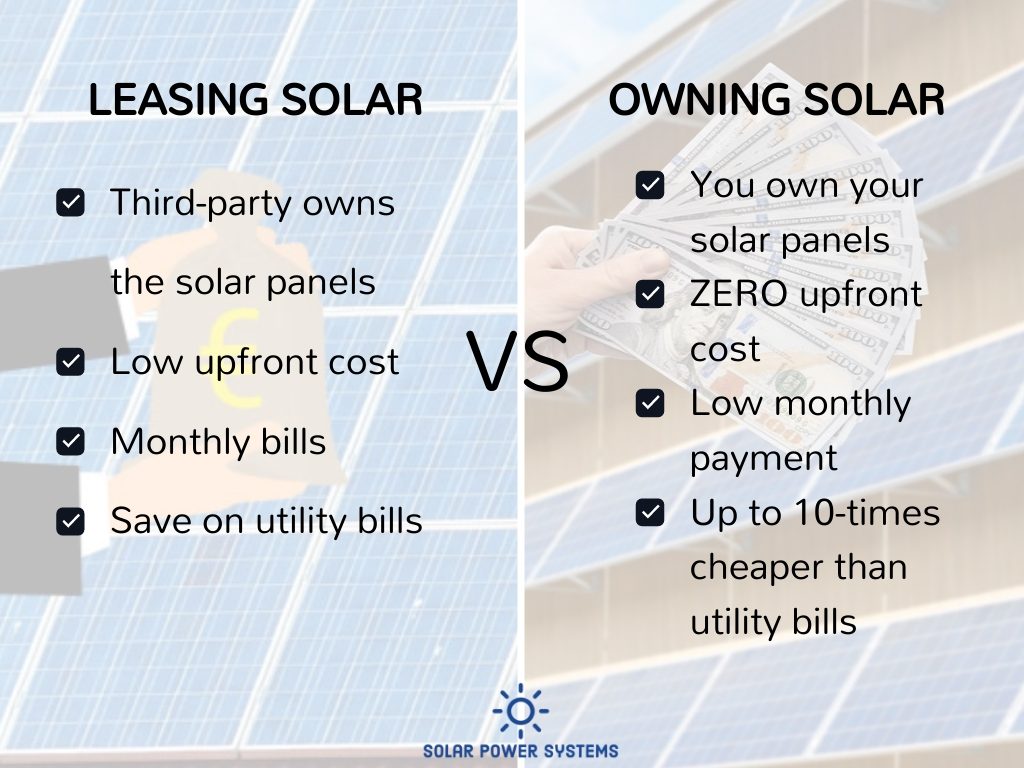

On the other hand, leasing solar panels involves entering into a contractual arrangement with a provider who is responsible for the system’s installation and upkeep in exchange for a minimal or nonexistent initial payment. The householder remits a fixed monthly charge to the organization that possesses the system.

Solar panels are anticipated to maintain their increasing prominence. In 2023, the Solar Energy Industry Association reported a 43% surge in installations within the United States. However, both leasing and buying solar panels have their advantages. Buying results in long-term cost reductions, while leasing solar panels provides an economical way to enter the renewable energy sector.

This article provides an in-depth look at the costs, benefits, and considerations of both options, ensuring that you have all the information you need to decide how much solar costs and whether to buy solar panels or opt for a solar lease.

How Does a Solar Lease Work?

By avoiding the obligations of ownership, a solar lease grants homeowners access to the benefits of solar energy. Usually, it operates as follows:

- Consultation: obtaining guidance from a solar service provider is the initial step in the procedure. The evaluation includes an assessment of property value, energy usage, and solar lease rights.

- Installation: the solar panels will be installed on your property by the provider if you choose to proceed. Installation of monitoring equipment and wiring the panels to the electrical system (roof or ground) are all components of this procedure.

- Usage agreement: users engage in a usage agreement, which is typically a power purchase agreement (PPA) or a lease, once the system is operational. The terms, including leased solar panels cost, are explained in the agreement.

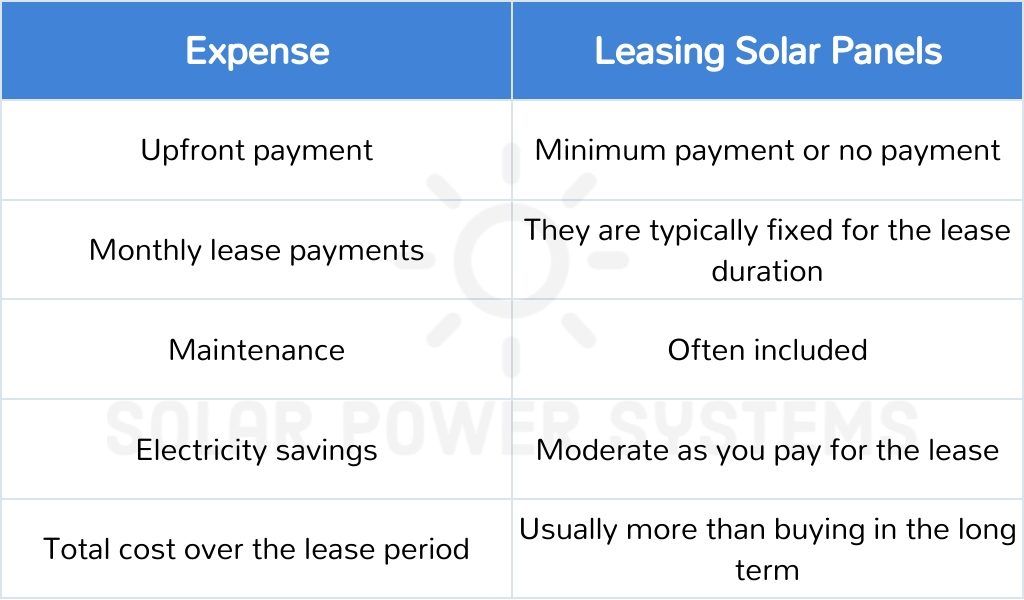

- Monthly payments: so, how much is a solar lease per month? Leasing solar panels costs comprise maintenance and financing costs in addition to the cost of the system. When evaluating the feasibility and advantages of transitioning to solar energy, these payments are a crucial factor.

- Energy production: solar panels produce electrical energy, which is then utilized to fuel the operation of a residential dwelling. The energy surplus generated may be stored in a battery or returned to the grid.

- Maintenance: the solar service provider is frequently obligated to perform upkeep on the leased solar panels as part of lease agreements that stipulate maintenance.

- End of lease options: upon the expiration of the lease term, you may be eligible for the following options: lease renewal, system purchase at a reduced price, or panel removal from your property.

Residential proprietors can benefit from solar energy without assuming the liability of ownership through the use of leased solar panels. In order to comprehend your financial obligation, it is critical, nonetheless, that you thoroughly examine the lease terms.

Source: solarreviews.com

How Does Buying Solar Panels Work?

The purchase of solar panels is a simple undertaking that confers full proprietorship of the solar energy system on the householder. It generally operates as follows:

- Consultation and assessment: the financial situation, energy needs, and suitability of the property for the installation of solar panels are evaluated.

- Design and proposal: the installer develops a solar panel system that is customized to your requirements in accordance with the assessment. After this, a proposal is presented, which contains comprehensive details regarding the number of panels, their positioning, and the anticipated energy output.

- Financing (if required): you have the option to buy solar panels directly from the manufacturer or investigate financing alternatives. When spreading the cost over a number of years, solar loans and other financing options are favored by many homeowners.

- Installation: following your approval of the proposal and acquisition of financing, the installer will initiate the installation process. It includes installing the panels on your residence, connecting them to the electrical system, and configuring monitoring equipment.

- Incentives and tax advantages: you are eligible to benefit from available incentives and tax advantages following installation. These can significantly reduce the overall cost of your solar panel system.

- Energy production: upon connection to the residential electrical system, the solar panels commence electricity generation. Energy that is not being used can be returned to the utility or stored for later use.

- Maintenance: the owner of the solar panels bears the responsibility for the system’s maintenance. Nonetheless, numerous solar panel manufacturers provide extended warranty coverage for repairs and maintenance.

- Long-term savings: energy bill savings over an extended period of time are substantial, as solar panels generate electricity at no cost. Long-term savings have the potential to compensate for the initial investment.

You gain complete control over your energy production, financial incentives, and ownership by buying solar panels.

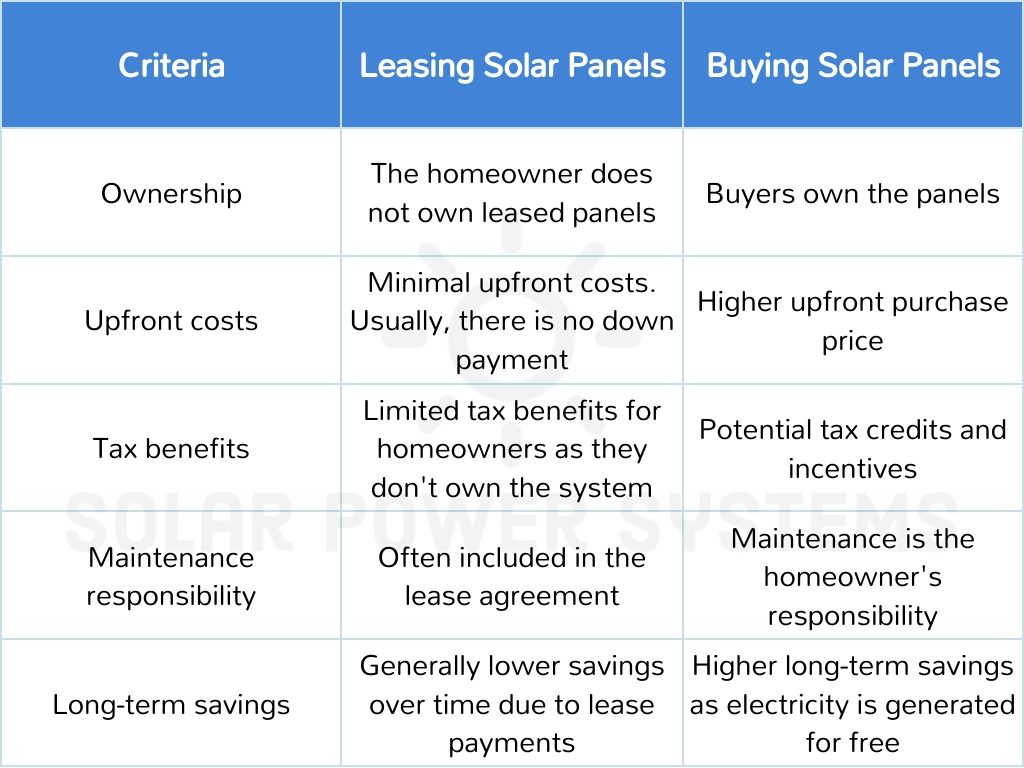

Key Differences Between Leasing vs Buying Solar Panels

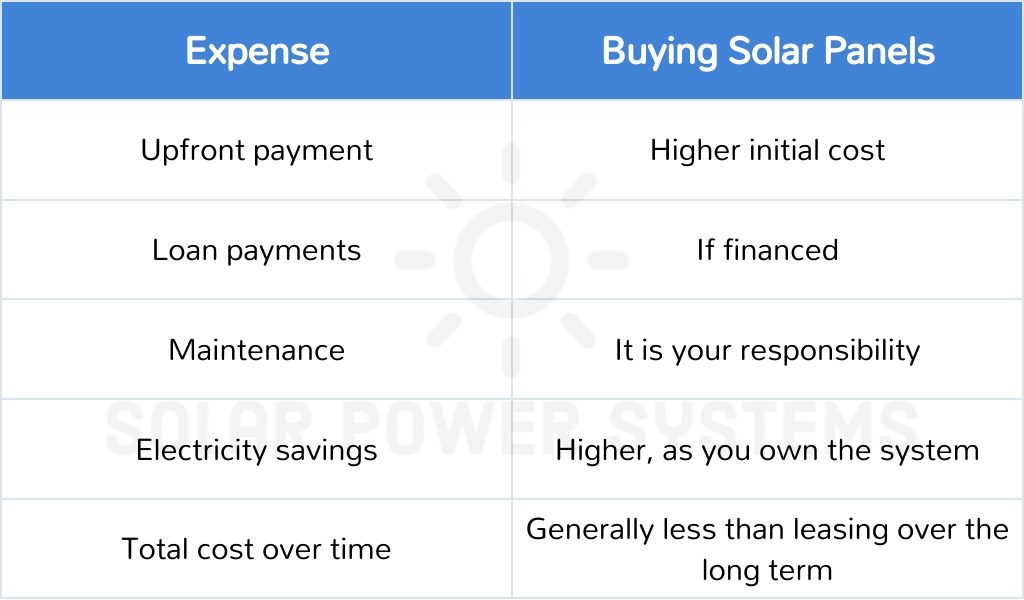

Cost of Leasing Solar Panels Vs. Buying Solar Panels

Cost of Leasing Solar Panels

The typical monthly cost of a solar lease is between $50 and $250. Even with interest on the loan for solar energy, you will still pay significantly more than if you had purchased the panels—roughly $40,000—assuming an average monthly payment of $150 and a 25-year lease period.

Cost of Buying Solar Panels

As of 2022, the typical cost of installing 8-kilowatt solar panels for households was estimated at $3 per watt. At this cost per watt, an 8-kilowatt solar system costs about $24,000, excluding incentives and rebates.

Solar Lease vs. Buy Calculator

It’s crucial to consider ownership benefits and long-term savings while choosing whether to buy or lease solar panels. To help you make an informed decision, you can use online solar lease vs buy calculators.

These tools take into account factors such as your location, energy usage, available incentives, and financing options to provide a customized comparison. Long-term costs can also be estimated, and savings for leasing and buying allow you to see which option aligns best with your financial goals. Calculators provide valuable insights to inform your decision-making process.

Buying vs Leasing Solar Panels Pros and Cons

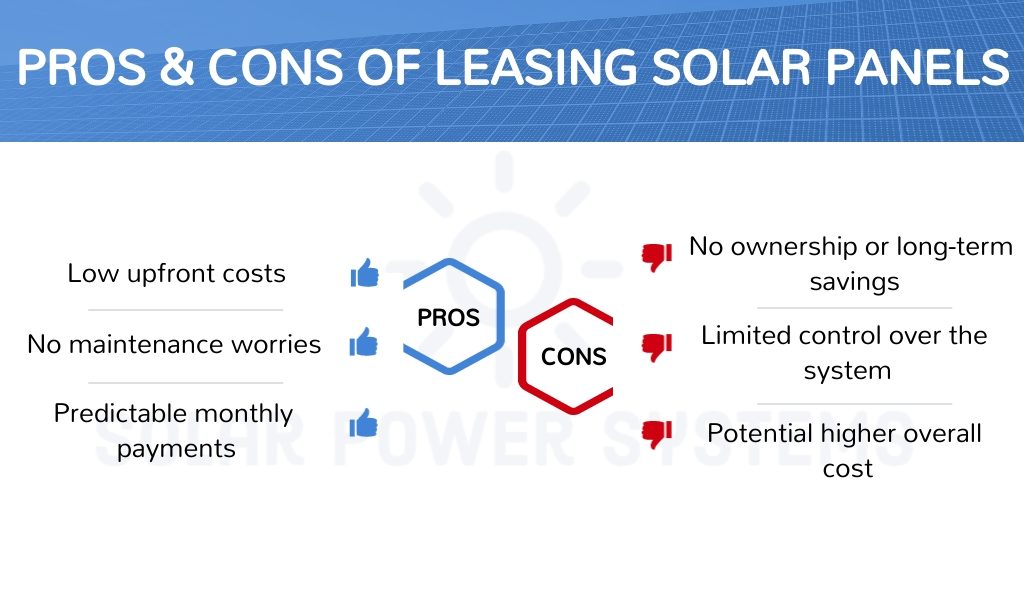

Leasing Solar Panels Pros and Cons

Leasing solar energy offers pros and cons, just like any other purchase option:

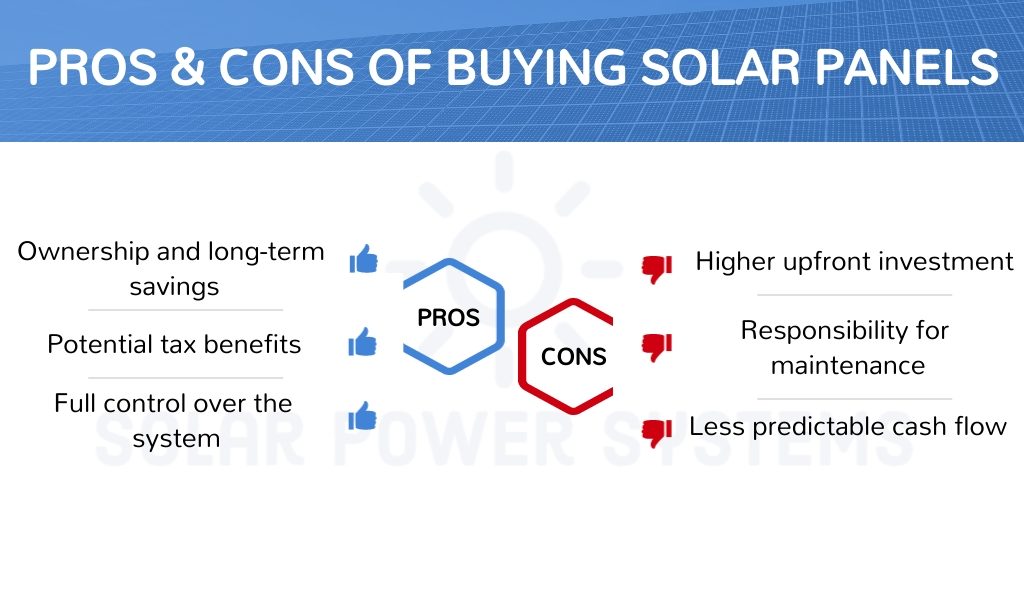

Pros and Cons of Buying Solar Panels

Buying solar panels instead of leasing is the key reason to save money over time. But while buying solar panels, you need to consider the pros and cons that are outlined below:

Benefits of Leasing Solar Panels Vs Buying Solar Panels

Benefits of Leasing Solar Panels

- Affordability: leasing makes solar power accessible to those who cannot afford the substantial upfront costs associated with buying solar panels.

- Maintenance inclusion: enjoy peace of mind with maintenance often included in the lease agreement, sparing you from unexpected repair costs.

- Predictable costs: fixed monthly lease payments provide budgeting stability, making it easier to manage your finances.

Benefits of Buying Solar Panels

- Ownership: buying solar panels means you own the system, making you eligible for various incentives, including tax credits and rebates.

- Long-term savings: while the initial investment might be higher, you’ll enjoy significant savings over the system’s lifespan as electricity is generated for free.

- Increased home value: solar panels can increase your home’s resale value, making it more appealing to potential buyers and potentially resulting in a higher selling price (The price difference between a home with and without solar panels is around 4%).

What to Consider When Choosing Between Leasing vs Buying Solar Panels?

Comparing the long-term benefits, leasing vs buying solar panels can be a pivotal decision for those looking to harness renewable energy for their homes. When making this critical decision, consider the following factors:

- Budget: evaluate your financial capabilities and willingness to invest upfront. Leasing requires minimal initial costs, while buying solar panels demands a more substantial investment.

- Ownership: decide whether you want to own the solar panels and enjoy long-term savings or prefer a hassle-free lease arrangement.

- Tax benefits: explore available tax credits and incentives, which are typically more advantageous for solar panel buyers.

- Maintenance: consider your willingness to handle maintenance responsibilities, which are included in most lease agreements but are your responsibility when buying.

- Duration: determine how long you plan to stay in your current home. Buying may be more advantageous if you plan to live in your home for many years, while leasing can be a better option for shorter-term arrangements.

- Local regulations: research local regulations, utility policies, and potential limitations on solar panel installation in your area.

- Environmental impact: assess your commitment to reducing your carbon footprint. Both leasing and buying contribute to a cleaner environment, but owning panels provides more direct control over environmental impact.

When considering whether to enter into a solar lease or buy a solar panel system, it’s crucial to weigh the long-term financial benefits and ownership advantages associated with each option.

Conclusion

Upon careful evaluation of the leasing solar panels and comparing the advantages and disadvantages, it becomes evident that each option has pros and cons. If you opt to buy solar panels, you make a significant upfront investment, but you gain full control over your energy production, benefit from federal tax credits, and increase the value of your property.

Leasing solar panels comes with less financial burden upfront; maintenance is typically covered by the leasing company, and you can start saving on your energy bills immediately. However, you may miss out on federal tax credits, which might complicate things if you decide to sell your house. Your financial situation, energy needs, and long-term plans should guide your decision between leasing vs buying solar panels.

You may want to consult with a solar energy expert before making a decision. Remember, switching to solar energy, whether you lease or buy, is a big step towards an eco-friendly lifestyle and lowering your carbon footprint.