In the sun-drenched landscapes of Arizona, the allure of “free” solar panels can be as intense as the midday sun itself. Yet much like the mirage in a desert, the concept of “free” solar panels is often misunderstood, warranting a closer inspection. The term may conjure up images of costless energy and significant savings without investment, but it’s essential to peel back the layers of this solar promise to uncover the real meaning behind it.

Firstly, it’s important to acknowledge the significant incentives and savings opportunities solar installations can offer to Arizonans. Indeed, the state’s abundant sunshine makes it an ideal location for harnessing solar energy. However, the market of solar energy is rife with nuanced offers and financial arrangements that suggest no upfront costs, but do not equate to outright free ownership of the panels. These deals often involve solar leases or Power Purchase Agreements (PPAs) which, while potentially beneficial, come with specific terms and responsibilities.

To truly understand the potential benefits and obligations of what seems to be a ‘free’ solar panel setup, it is critical to dive into the depths of these agreements. Your journey into the solar panel landscape doesn’t have to be a solo venture. Arm yourself with knowledge and discover the range of options available that make solar power accessible and often highly advantageous for Arizona homeowners. So, whether you’re looking to offset energy costs, reduce your carbon footprint, or simply explore the feasibility of solar panels for your home, let’s shed some light on the reality behind ‘free’ solar panels and how they can lead to real savings in the long run. Continue exploring with us and unlock the secrets to smart solar installation in the Grand Canyon State.

Are “Free Solar Panels” Really Free?

When you come across the term “free solar panels,” it’s crucial to understand what it really entails. While it might imply that solar panels are being given away at no cost, the reality within the solar industry is quite different. “Free solar panels” usually refer to a financial arrangement known as a solar lease or a Power Purchase Agreement (PPA). Under these models, a solar company installs panels on your home without demanding any upfront payment, which sounds like a great deal at first glance.

However, the catch lies in the long-term commitment you make. In a solar lease, you agree to pay a fixed monthly rent for the use of the solar panels. This payment is for the leasing service and maintenance of the solar equipment on your property. The solar company retains ownership of the panels, and in return, you benefit from the electricity they produce, which can be cheaper than buying electricity from the utility grid.

A PPA is slightly different but follows a similar concept. Instead of leasing the equipment, you agree to purchase the power generated by the panels at a set per-kWh price from the solar company. This price is typically lower than what you would pay your utility provider, which can save you money on your electricity bills.

While both options require no upfront investment, they do mean you are tied into a long-term contract, typically around 20 to 25 years, and you will have a monthly payment. Additionally, because you don’t own the panels, you don’t receive the same incentives as you would if you purchased them outright, such as federal tax credits.

In Arizona, with its ample sunshine, solar leases and PPAs can be especially attractive as they may offer significant savings on energy costs. However, it’s important to weigh the pros and cons carefully, considering the duration of the agreement and the long-term financial implications. Always read the contract terms thoroughly and consider how a lease or PPA might affect the value of your property if you decide to sell before the contract term ends.

What Do Companies Mean When They Refer to Free Solar Panels?

“Free solar panels” is an enticing phrase that solar companies in Arizona might use to grab your attention. As an informed Arizonan, it’s important to unravel what this promotion actually involves. Typically, there are a few common offers behind the promise of gratis solar energy:

Lease Agreements: Through a solar lease, companies offer you solar panels at no upfront cost. In essence, the company installs their equipment on your property, and you pay a monthly fee to lease the equipment. This fee is usually less than what you’d pay for regular electricity, providing potential savings on your energy bill. However, since you’re leasing, you don’t own the panels and aren’t eligible for incentives like the federal investment tax credit.

Power Purchase Agreements (PPAs): Similarly to a lease, a PPA means the solar company owns the panels on your roof. Instead of a fixed lease payment, you agree to buy the power generated by the panels at a set rate, which common practice keeps below market rates, meaning potential energy bill savings. However, just like with leases, you miss out on tax credits and rebates.

Solar Loans: Some “free solar panel” promotions involve zero-down solar loans. These allow you to finance the total cost of the system with no initial outlay, effectively owning the system and qualifying for tax credits. Over time, you repay the loan, ideally using the savings on your lower electricity bills to offset the loan payments.

Regardless of the offer, it’s important to read the fine print. Here are some key points to consider:

– Contract Duration: Leases and PPAs often lock you into long-term contracts, typically for 20-25 years.

– Energy Savings: Calculate expected savings carefully and consider future rate hikes.

– Transfer of Ownership: If you sell your home, transferring a lease or PPA can be complex.

– Maintenance and Repairs: Understand who is responsible for the system’s upkeep.

– Increases in Payments: Some contracts have escalating payments over time, which could affect your long-term savings.

Remember, the term “free” refers to the absence of initial costs, not to a complete absence of cost. It’s essential to analyze the long-term implications of any solar panel promotion and decide whether it aligns with your financial and energy goals. As with any long-term financial commitment, consulting with a knowledgeable financial advisor or an independent solar consultant could be a smart move to ensure you’re making the best decision for your individual circumstances.

Solar Leases

Solar leases in Arizona are agreements where a homeowner rents the solar panels from a leasing company for a fixed monthly fee. This fee is generally less than what their typical electricity bill would be. The leasing company installs, maintains, and repairs the solar panel system for the duration of the lease, which typically lasts 20-25 years.

One of the main benefits of solar leases includes the reduction in energy costs from day one, with no upfront investment. Since the leasing company is responsible for the system, homeowners can also enjoy peace of mind without worrying about maintenance or repairs.

Another advantage is the potential positive impact on home value. Although this can vary, homes with solar energy systems often appeal to buyers due to the prospect of reduced utility bills.

However, solar leases also have drawbacks. Because the leasing company owns the system, any available tax credits or financial incentives go to them, not the homeowner. Additionally, the lease payments usually increase annually by a pre-set rate, which could eventually reduce the cost savings over time.

When it comes to long-term costs and savings, solar leases may end up being more expensive than purchasing a system outright. This is due to the cumulative cost of lease payments over the years potentially surpassing what a solar energy system costs to buy and install. However, if the homeowner is not able or willing to invest a large amount of money upfront, a lease can provide a no-money-down way to go solar and save on electricity bills from the start.

Here’s a breakdown of potential savings and costs:

- Upfront Costs: $0 with a solar lease, but substantial with a purchase.

- Monthly Costs: Fixed lease payment, often escalating annually, compared to potential $0 bill if the system is purchased and sufficiently covers energy needs.

- Long-Term Savings: More limited with a lease due to lease payments; greater with a purchase, especially after the breakeven point is reached.

- Incentives and Rebates: Benefit the leasing company, not the homeowner, in a solar lease agreement.

When considering a solar lease, it’s important for homeowners to weigh the immediate savings and hassle-free maintenance against the long-term financial benefits of owning a solar panel system. By analyzing current electricity bills and comparing them to projected lease payments (including annual increases), homeowners can decide which option aligns best with their financial goals.

PPA Agreements

Power Purchase Agreements (PPAs) are a financial arrangement particularly popular for solar energy projects, including in the sunny state of Arizona. In a PPA, a homeowner agrees to allow a solar company to install a solar panel system on their property. Instead of purchasing the system, the homeowner buys the electricity generated by the panels from the solar company at a set rate, which is often lower than the local utility rate.

Pros of PPAs for homeowners in Arizona:

- No or low upfront costs for the installation of solar panels, making it financially accessible to start saving on electricity bills.

- Fixed electricity rates can protect against future utility rate increases.

- Minimal responsibility for the homeowner, as the solar company typically handles maintenance and repairs.

- Can immediately enjoy lower electricity bills without waiting for the return on investment that comes with buying a system outright.

- Potential to increase property value by having a solar energy system in place.

Cons of PPAs for homeowners in Arizona:

- Limited control over the solar equipment since it’s owned by the provider.

- PPA contracts typically last for 20 to 25 years, which can complicate selling the home if the new buyer doesn’t want to take over the agreement.

- Less financial benefit than owning a system because homeowners are not eligible for tax credits or incentives.

- Electricity rates, although lower initially, may escalate over time depending on contract terms.

Buying a solar system outright or through financing is different from a PPA in several key ways:

- Owning the system means the homeowner can claim tax credits and rebates.

- Electricity generated becomes free after the system is paid off, leading to greater savings in the long run.

- Increases home value with the added benefit of a solar asset that potential buyers generally view favorably.

Leasing a solar system is similar to a PPA in that there’s typically low or no upfront cost and the leasing company retains ownership and maintenance responsibilities. However, leasing terms usually include a fixed monthly payment for the use of the system rather than payment for the amount of electricity produced.

When considering a solar system in Arizona, you’ll want to weigh the cost, your personal financial goals, and the level of responsibility you’re willing to take on. PPAs can offer a quick and easy way into solar energy without the burden of ownership, while buying or leasing might better suit those seeking long-term financial benefits and control over their solar investments. It’s always recommended to consult with a solar advisor to understand which option is best aligned with your specific needs and circumstances.

Zero-down Solar Loans

Zero-down solar loans are a financing solution that makes it easier for homeowners to switch to solar energy without the upfront financial burden. Rather than paying for the entire solar panel system upfront, as in traditional purchasing methods, this option allows you to install solar panels on your property with no initial investment. Instead, you repay the loan over time with the savings you accrue from using solar power.

One key benefit of zero-down solar loans is their immediate impact on electricity bills. Here are some advantages you may want to consider:

- Accessibility: This financing makes solar power more accessible to a larger number of homeowners, regardless of their current financial situation.

- Ownership: Unlike solar leases or Power Purchase Agreements (PPAs), zero-down loans lead to ownership of the solar system, which can increase your home’s value.

- Financial Savings: Over time, the cost savings on your electricity bill can offset the repayments for the solar installation, potentially leading to overall cost savings.

- Tax Incentives: Homeowners may be eligible for tax credits and rebates, which can further reduce the cost of going solar.

However, like any financial option, there are risks and considerations:

- Long-Term Commitment: A zero-down loan is a long-term financial commitment that typically spans several years.

- Credit Implications: Your creditworthiness is an important factor, and failure to make payments on the loan could negatively impact your credit score.

- Interest Payments: Over the life of the loan, you’ll pay interest, which can make the total system cost higher than if you had paid cash outright.

- Changes in Energy Savings: Projected savings depend on future energy costs and consumption, which can fluctuate.

It’s essential to consider the specifics of your situation, such as your electrical consumption, the feasibility of installing solar panels in your home, and your long-term financial planning. Be sure to do your homework, compare offers from different lenders, and consider consulting a financial advisor to ensure that this solar investment aligns with your personal financial goals. Remember, while the immediate allure of zero-down is tempting, thoughtful consideration of the long-term financial picture is crucial.

Can You Get Free Solar Panels From the Government?

The US government does not directly offer free solar panels to individuals or businesses in Arizona or any other state. However, there are government incentives and programs that can significantly reduce the cost of solar panel installation. These incentives sometimes create the misconception that solar panels could be “free,” while in reality, they are offered at a lower cost due to subsidies and credits.

Here are a couple of key programs and incentives that you should be aware of if you’re considering solar energy in Arizona:

Federal Solar Investment Tax Credit (ITC):

This is a federal tax credit for solar energy systems installed on residential and commercial properties. The ITC can provide a substantial reduction in the cost of a solar system because it allows you to deduct a percentage of the solar installation costs off your federal taxes. As of my last update, the ITC offers a 26% tax credit for systems installed by December 31, 2022, which will drop to 22% for systems installed in 2023. After 2023, the residential credit will drop to 0% while the commercial and utility credit will drop to a permanent 10%.

Arizona-specific Incentives:

Arizona also offers various state-level incentives, which include:

Net Metering

It allows customers who generate their own electricity to feed excess power back into the grid in exchange for credits.

State Tax Credit

Arizona provides a state tax credit up to $1,000 to help reduce the cost of a solar panel facility.

To take advantage of these incentives and programs, the application process typically involves:

- Choosing a qualified solar installer who is familiar with local, state, and federal solar incentives.

- Allowing the installer to assess your energy needs and prepare a solar panel system design.

- Applying for federal ITC by completing IRS Form 5695 and including it in your tax return.

- Checking and applying for any state-specific incentives. Your installer can often help with this.

- Coordinating with your local utility company for net metering.

Eligibility for these programs generally requires that:

- You own the property where the system is installed.

- The solar panel system is new and not previously used.

- The installation is completed by a qualified professional.

- The solar panels are used to generate electricity for the location and are not for resale.

Keep in mind that incentives can change, so it is important to regularly check for updates on the federal and Arizona state websites dedicated to energy and tax incentives. Additionally, it’s wise to engage with a solar consultant or a tax professional to ensure you are receiving the most accurate and up-to-date information regarding solar incentives and how they may apply to you.

Will “Free” Solar Panels Save You Money?

When considering ‘free’ solar panels in Arizona, there are several factors you should take into account to determine if they could lead to significant savings compared to traditional electricity costs.

First, the term ‘free’ often refers to solar lease or power purchase agreements (PPAs), which mean that a third-party owns the solar panel system on your roof. Although you may not have to pay upfront costs, these agreements typically require you to pay for the power produced by the system, which can be at a lower rate than the utility’s electricity rate.

Here’s how the savings might stack up:

Electricity Rates

In Arizona, the average residential electricity rate is above the national average. With relatively high sunshine amounts, this means solar power could be a cost-effective option.

Solar System Costs:

- Leased solar systems offer savings without the initial investment. If the agreement promises a rate lower than the current utility price, homeowners can start saving immediately.

- However, you should be aware that leases or PPAs typically include an escalator clause, meaning the cost per kilowatt-hour (kWh) could increase annually.

Performance

Arizona’s abundant sunshine makes it one of the best states for solar power, potentially increasing the amount of energy your system can produce and your overall savings.

Grid Electricity Prices

Utility prices may rise over time. With a fixed solar PPA rate, potential savings could also increase as traditional electricity costs go up.

Considering the financial viability:

- Long-Term Savings: While ‘free’ solar panels can lead to immediate savings on monthly electricity bills, the total long-term savings are usually less than what you would save if you purchased the system outright.

- Resale Value and Ownership: Solar leases or PPAs can complicate the sale of your house since the agreement must be transferred to the buyer. Alternatively, owning your own system can increase the value of your home.

- Energy Independence: Owning your solar panel system allows you to benefit from full energy independence and hedge against future increases in utility rates, whereas a lease or PPA provides a more limited benefit.

While the upfront expense is zero, you should calculate the total cost and savings over the lifetime of your solar panel system, considering the terms of your particular agreement. Always compare multiple options and read the fine print. It’s advisable to consult with a financial advisor or a solar consultant to ensure that a ‘free’ solar panel lease or PPA aligns with your financial goals and energy needs over the term of the agreement.

The Hidden Costs of “Free” Solar Panels

When considering ‘free’ solar panel offers, it’s important to approach with a discerning eye. In such deals, hidden or unexpected costs often emerge, which can impact homeowners financially in the long run.

Firstly, the term ‘free’ can be misleading. Typically, these offers are Power Purchase Agreements (PPAs) or solar leases, where you don’t own the panels outright, but agree to buy the power they generate, often at a lower rate than your utility. However, this means:

- Ongoing Payments: While you’re not paying for the solar panels, you are committing to a long-term contract with regular payments for the energy produced.

- Escalation Clauses: Many contracts include an annual price increase, or escalation clause, which can elevate costs over time, possibly erasing initial savings.

Secondly, there are potential maintenance and insurance considerations:

- Maintenance Fees: Although maintenance is often included, if it’s not, unexpected repairs could add to costs.

- Insurance: It’s essential to check if additional homeowners insurance is needed for the solar panels, leading to higher premiums.

Lastly, consider the implications of selling your home:

- Transferability: Solar contracts usually last 20-25 years. If you sell your home, the new owner must agree to take over the contract, which could complicate the sale.

For homeowners, while these offers can reduce monthly utility bills, it’s crucial to factor in the financial implications over the entire length of the contract. This includes understanding how the payment structure works, any potential increases in payment over time, and the terms and conditions related to selling your home.

By considering these factors, you can avoid unexpected burdens and make an informed decision that will benefit you financially over the long term. Always read the fine print and possibly consult with a financial advisor to ensure that the ‘free’ offer aligns with your long-term financial goals.

Arizona Solar Incentives, Tax Credits, and Rebates to Reduce the Upfront Cost

Solar incentives and rebates are financial benefits offered to homeowners to reduce the cost of installing and using solar energy systems. Arizona residents can take advantage of various incentives that make switching to solar power more affordable and economically viable. These incentives can lower upfront costs, offer tax reductions, and provide additional savings over time, making solar energy an attractive investment. Some incentives come in the form of tax credits that reduce the amount of tax owed, while others may be rebates that directly cut the installation costs. These financial benefits, along with the long-term savings on energy bills, can significantly benefit Arizona homeowners looking to switch to solar power.

| Incentive | Savings | Explanation | Type | Occurrence |

|---|---|---|---|---|

| Federal Solar Investment Tax Credit (ITC) | 26% of installation costs | A federal income tax credit for a percentage of the cost of a solar PV system, both for residential and commercial. | Tax Credit | One-time (though can be carried over to the next tax year if the taxes owed are less than the credit) |

| Arizona Solar Energy Tax Credit | $1,000 | A state tax credit to reduce the cost of installing a solar system, up to $1,000 or 25% of the cost, whichever is less. | Tax Credit | One-time |

| Property Tax Exemption | Varies | Exempts the added value of a solar installation from property tax assessments. | Property Tax Incentive | Ongoing for the life of the solar energy system |

| Net Metering Policies | Varies by utility | Customers are credited for excess solar electricity sent back to the grid at a retail or near-retail rate. | Billing Mechanism | Ongoing |

| Local Utility Rebate Programs | Varies by provider | Local utilities may offer rebates for solar system installation, which reduces upfront costs. | Rebate | Occasional, subject to utility program availability |

| Solar Equipment Sales Tax Exemption | 5.6% of equipment costs | Exempts the purchase of solar energy devices from state sales tax. | Tax Exemption | One-time |

Note: The specifics of these programs, particularly the local utility rebates and net metering policies, can vary. It’s important for residents to check with their local utility providers and stay updated with the current policies and incentives. The Federal Solar Investment Tax Credit is subject to change based on federal energy policies.

How to Choose The Best Solar Company in Arizona

Selecting the right solar installer is crucial for a successful and satisfying transition. The unique climate and regulatory environment of Arizona require particular consideration. Here’s a list of key factors and considerations homeowners should keep in mind:

- Installer Experience and Certifications: Look for a company with a proven track record in Arizona. An installer with extensive local experience is likely familiar with state-specific installation codes and can optimize systems for the Arizona climate. Certifications, such as the North American Board of Certified Energy Practitioners (NABCEP), are indicative of dedicated and knowledgeable professionals.

- Customer Reviews and Reputation: Customer testimonials and reviews are invaluable for gauging overall satisfaction and the installer’s ability to handle project-specific challenges. Look for patterns in feedback, such as comments on their professionalism or the effectiveness of the solar systems installed.

- Warranty Offerings: Comprehensive warranties ensure protection for your investment. Check warranty length and coverage, including parts, labor, and performance guarantees. Some top-tier solar panels come with 25-year warranties, an important consideration for long-term reliability.

- Service Offerings: Your needs may go beyond installation. Full-service companies provide system design, financing, installation, maintenance, and monitoring services, offering a more seamless experience from start to finish.

- Local Regulatory Knowledge: Arizona-specific incentives and regulations, like the Solar Equipment Sales Tax Exemption and the Residential Arizona Solar Tax Credit, can significantly impact the cost and feasibility of solar installation. An adept installer will navigate these efficiently and pass the benefits on to you.

- Climatic Considerations: Arizona’s high temperatures and sun exposure can affect solar panel efficiency. Seek an installer knowledgeable in high-performing, durable panels and cooling technologies suitable for the local climate.

- Post-Installation Support: Check if the installer provides post-installation support and maintenance services. Having an accessible team ensures your solar system operates optimally and issues are promptly resolved.

By carefully considering these factors, homeowners in Arizona can partner with a solar installer that meets their energy needs, respects local regulations, and ultimately provides a reliable, cost-effective solar energy system. The abundance of sunlight in Arizona makes it an excellent candidate for solar investment, and choosing the best installer is the first step to harnessing this renewable energy source efficiently.

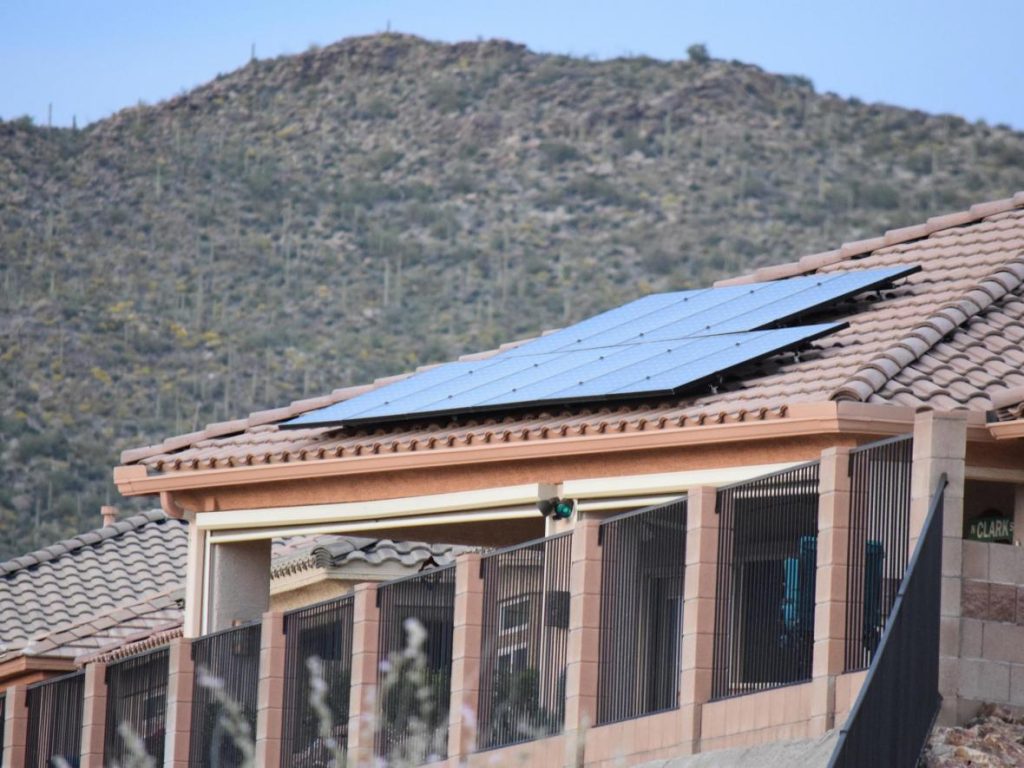

Important Solar Installation Factors to Consider in Arizona

There are several key factors you need to take into account to ensure that your investment is as beneficial as possible, both financially and environmentally.

First, let’s talk about the climate conditions. Arizona is known for its substantial sunlight, making it an ideal location for solar power generation. The state averages about 299 sunny days per year, which can lead to substantial energy production from your solar panels. However, it’s also important to consider the heat:

- High temperatures can affect the efficiency of your solar panels. As they get hotter, their ability to convert sunlight into electricity can decrease. Therefore, choosing high-quality panels designed to withstand the Arizona heat is essential.

- Dust and sand can accumulate on the panels, so regular cleaning may be necessary to maintain optimal performance.

Regarding state regulations and incentives, Arizona is quite solar-friendly:

– Net Metering: Arizona residents can benefit from net metering, which allows you to sell excess energy back to the grid.

– State Tax Credits: Arizona offers a state tax credit for solar installations, reducing the overall cost.

– Solar Equipment Sales Tax Exemption: There is also a sales tax exemption for the purchase of solar equipment in Arizona.

Before making any decisions, you should also conduct a property assessment to ensure that your home or business is suitable for solar panels:

- Evaluate your roof’s condition, age, and orientation. The roof should be in good condition and have a southward orientation for optimal sunlight exposure.

- Consider any obstructions such as trees or nearby buildings that might cast shade on your panels, as this can significantly reduce their effectiveness.

- Assess the local zoning laws and homeowners’ association regulations, if applicable, as they may have specific rules regarding solar panel installations.

Lastly, to make an informed decision and navigate the specifics of installing solar panels in Arizona, it’s prudent to consult with local solar energy experts. They’ll help tailor a solar solution that fits your needs, manages the unique climate considerations, and takes full advantage of the state’s regulations and incentives. This way, you’ll be equipped to make the most of Arizona’s abundant sunshine, while also contributing to a greener future.

Wrapping Up: Understanding “Free” Solar Panels

When considering ‘free’ solar panels in Arizona, it’s essential to understand the specifics of what this offer entails. Firstly, ‘free’ typically means a solar lease or Power Purchase Agreement (PPA), where you don’t pay for the solar panels themselves but for the electricity they produce, often at a lower rate than your local utility.

The benefits of such an arrangement include:

- No Upfront Costs: Homeowners can avoid the significant initial investment required to purchase and install solar panels.

- Reduced Energy Bills: Solar leasing can result in immediate savings on your electricity bill.

- Maintenance: The leasing company typically handles maintenance and repairs, reducing the homeowner’s responsibility.

- Environmental Impact: Using solar energy helps reduce carbon footprint and reliance on fossil fuels.

However, there are several important considerations:

- Long-term Contracts: Leases and PPAs often lock homeowners into long-term agreements that may last 20-25 years.

- Property Value: The impact on property value can be positive or negative, depending on the buyer’s perspective on leased solar equipment.

- Less Financial Benefit: While you save on energy costs, you don’t benefit from solar incentives and rebates as much as you would if you owned the panels outright.

- Limited Control: You have less control over your rooftop and the equipment since the solar provider owns the panels.

For homeowners in Arizona, leveraging the state’s abundant sunshine through ‘free’ solar panels can be attractive. Yet, it’s crucial to carefully review the lease or PPA terms, consider your long-term property plans, and compare it with the option of purchasing the system to ensure the best decision for your specific situation. Consulting with a solar energy expert or a financial advisor is also wise to fully understand the implications and benefits of installing solar panels in Arizona.