It is undeniable that the solar power solution trend is here to stay. This economical and sustainable technology brings benefits not only to the environment but also to homeowners. If you want to go solar but worry about it being too expensive, you may consider government solar panel programs functioning nowadays. Multiple solar incentives help homeowners maximize the cost-efficiency of their solar panel systems.

The availability of solar incentives and tax credits varies in your house location and depends on current solar energy policies in the area. Additionally, your household must meet specific solar panel rebate eligibility requirements. That’s why potential solar panel owners should keep up-to-date regarding solar incentives available.

This blog post will help you evaluate the approximate cost of solar panel installation for your house and offer a brief overview of 2024 government solar rebate programs. They can significantly reduce the solar installation price and make your transition to renewable energy sources smoother.

How Expensive Is Solar Panel Installation?

Equipping your property with solar panel systems is an effective way to save tens of thousands of dollars. However, the total cost of the solar array system can be discouraging, especially in a time of economic uncertainty. Unless you take advantage of solar incentives and solar panel rebate initiatives, you should be ready to invest between $17,000 and $23,000 for a system.

However, there are many ways how you can break even on your solar expenses in six to ten years. Let’s review the factors influencing how much money you have to invest to switch to solar power.

There are several crucial factors influencing solar panel installation costs:

Your Household Electricity Consumption

The electricity required to meet your monthly household demand will directly influence how big a solar panel system should be.

Payment Method

Solar panel owners can use a one-time lump sum payment, a solar lease program, or a Power Purchase Agreement (PPA). Each payment method has pros and cons and affects how big your expenses are in the long run.

Daily Exposure to Sunlight

Since solar panels generate electricity using sunlight, your location will significantly influence how much money you’ll save adopting solar technology.

Solar Panel Type and Quality

Though the task may sound challenging, you should strive to balance solar panel quality and price. Finding the solar panel type that fits your budget guarantees that you’ll be able to maximize your solar return on investment.

Source: Mitsui Chemicals India

Government Solar Incentives

Solar panel owners are eligible for numerous solar panel rebates and solar incentives. Applying for solar tax rebate programs and federal solar incentives efficiently reduces the initial solar investment sum.

What Are Government Solar Panel Programs?

Solar incentives and rebates are financial encouragements supported and provided by federal, state, or local government representatives. They aim to promote solar technology adoption among individual homeowners and business enterprises.

Government solar panel rebate programs help potential solar system users reduce the upfront investment and decrease the solar system cost across its lifetime.

You can apply for various types of solar incentives, including:

- Solar tax rebates

- Solar tax exemptions

- Cash rebates

- Feed-in tariffs

- Performance-based solar incentives

Commercial Solar Panels Rebates

Business owners nationwide seek innovative solar panel installation options. One of the ways to decrease the total cost of commercial solar power is to utilize government programs for solar panels. With such solar incentives, you can significantly cut down your upfront expenses. It results in a shorter payback period and improved ROI.

Let’s discuss the best government incentives for solar panels in 2024 that business owners can take advantage of.

Federal Tax Incentives for Solar Energy Used by Businesses

Two forms of federal solar rebates are available for commercial businesses and nonprofit organizations. Business owners become eligible for these solar incentives after installing solar systems. It’s important to note that businesses usually qualify for either one type of solar incentive, not both.

| Investment Tax Credit | Production Tax Credit for Businesses |

| The most popular government solar panel program for businesses is the investment tax credit (ITC). This solar tax rebate helps reduce your federal income tax liability. In 2024, it is expected to see a 30% decrease. | The production tax credit (PTC) is another form of solar panel federal tax credit. It depends on how much electricity your industrial solar system generates within the first decade of operation. Using PTC makes you eligible for a base credit per kWh of electricity produced. Your PTC provider will also adapt the rate to account for annual inflation. |

Since each solar rebate has benefits and drawbacks, you should choose between ITC and PTC wisely. Many commercial solar panel owners go with the ITC because it offers upfront solar incentives with a fixed amount.

However, business projects in areas with high sunlight exposure can benefit more from the PTC. That’s why consulting a tax professional before choosing the most suitable government solar panel program is efficient.

REAP Grants for Businesses

Another government solar panel program businesses can benefit from is The Rural Energy for America Program (REAP). It aims to offer loan financing and grant funding in the agricultural sphere. The program mainly supports rural small businesses equipped with solar array systems.

If your business qualifies for REAP, you can obtain the following solar rebates:

- A loan guarantee on loans (not more than 75% of total project value)

- Grants (not more than 50% of total project value)

- Combined grant and loan guarantee (at least 75% of total project value)

You can also combine the REAP government solar panel program with a federal solar tax credit. In such a case, you can decrease the amount of money spent on solar system installation by 80%.

MACRS Depreciation Solar Panel Rebate

Business owners transitioning to solar power can apply for Modified Accelerated Cost Recovery System (MACRS) depreciation. This government solar panel program allows businesses to receive annual tax deductions. Such federal tax rebates help recover the cost of solar panel assets quickly. Commercial solar array systems that meet MACRS requirements can use tax deductions during a 5-year recovery period.

Commercial Solar Incentives for Non-Profits

Non-profit organizations were not eligible for solar incentives provided for commercial entities since most of organizations are tax-based. However, in 2022, the introduction of The Inflation Reduction Act changed the picture. Now, schools, churches, and other non-profit groups can apply for some solar power rebates.

| Elective-Pay ITC | Credit Transfer |

| Non-profit organizations can claim a direct payment to compensate 30% of solar system installation costs instead of the ITC government solar panel program. | Non-profit organizations not eligible for elective-pay ITC can sell their tax credit to other taxpayers. |

Individual Solar Panel Incentives

Residential solar array systems are getting more affordable each year. Homeowners can effectively reduce solar panel installation costs because of multiple government programs for solar panels and other solar incentives used on residential property.

Here is what you need to know about the most popular government solar panel rebate initiatives.

Solar Investment Tax Credit (ITC)

The Investment Tax Credit helps homeowners decrease their solar installation expenses by providing a 30% income tax bill for the system installation’s total value. For instance, if the cost is around $20,000, the homeowners can apply for the ITC close to $7,000.

Fortunately, the recently adopted Inflation Reduction Act extended the ITC availability till 2032 (30%). Then, It will decrease to 22% in 2034 and stop functioning in 2035.

The Federal Tax Credit compensates for solar installation costs, labor expenditure, and equipment prices by 30%.

Here is the list of expenses covered by such solar tax rebates:

- Solar arrays and battery storage

- Inverters and wiring

- EV charging equipment

- Solar licenses and permits

- Other expenses stated in the solar system installation invoice

Now, let’s discuss what makes you eligible for ITC.

First, you should own the system to benefit from this government solar panel program. In other words, those homeowners who used a solar lease or a power purchase agreement are not eligible.

Other ITC requirements include:

- Your solar system installation occurred between 01/01/2006 and the present

- The solar arrays function in your residence

- You installed a new solar panel system

- You reside in a USA-located house

Other Residential Government Solar Panel Programs

Federal solar rebates are not the only form of solar rebate available for US residents. We offer you a concise overview of other solar incentives individual solar panel owners can apply for.

| Solar Panel Rebate | Description |

| State Government Solar Rebate | The State Government Solar Rebate makes it possible for each state to provide solar incentives that are unique to the state. You can find all the necessary information on your area’s government solar panel program using the DSIRE database. |

| Solar power rebates for electric utilities | This government solar program issues solar incentives for qualifying solar array installations. These solar panels rebates function with the support of local utility providers. The DSIRE database contains information on the availability of such solar power rebates in your area. Alternatively, you can consult your local electricity provider. |

| SRECs | SRECs are payments for renewable energy certificates. They are performance-based solar incentives. You can claim credits depending on how much energy your solar system generates. Later, you can sell these credits on an open SRECs market. Homeowners are entitled to one SREC for one megawatt-hour of the electricity produced by their home-based solar panel systems. |

| Low-interest solar loans | You can reduce solar system installation expenses by applying for this type of solar loan. It allows you to benefit from a decreased interest rate of as low as 3.99%. Mind, this government incentive for solar panels is unavailable in all the states. |

| Net Metering | The Net Metering government solar panel program allows you to sell overproduced energy to the grid. It is one of the most beneficial solar incentives available. |

| REAP Grants | Homeowners can benefit from this solar panel rebate initiative by obtaining up to 50% compensation of the solar system cost. These solar incentives include both system purchasing and installation expenses. |

| Bonus Depreciation | This solar tax rebate allows you to take 100% of the depreciation value within the first year and decrease your tax bill. |

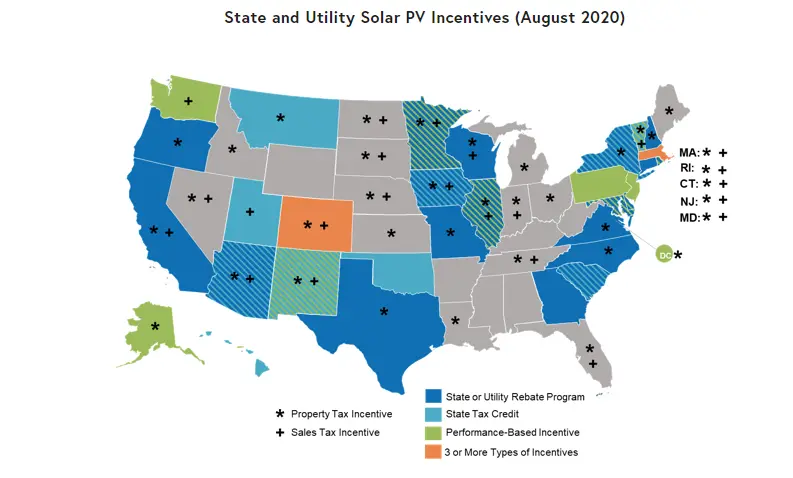

Unique State Solar Incentives and Solar Panel Rebates

Depending on the location of your property, you can take advantage of some solar incentives and government solar panel programs that are not available elsewhere.

Source: DSIREinsight

| Arizona | The state can offer 25% solar tax rebates and personal income tax reductions. |

| California | You can apply for the Single-Family Affordable Solar Housing Government Program for solar panels, allowing disadvantaged homeowners to claim financial incentives for solar energy produced. |

| Colorado | The state residents can use solar incentives in the form of tax exemption (9%). |

| Connecticut | The homeowners who purchased their solar systems can apply for the Green Bank Residential Solar Investment Program and benefit from an upfront cost decrease. |

| Florida | If you are located in Florida, you can use Solar System State Tax Exemption. This solar panel rebate entitles you to a 6% tax exemption rate. |

| Hawaii | The state authorities provide solar panel owners with tax exemption solar incentives for rooftop solar array systems. |

| Illinois | Illinois supports low-income solar owners with a government solar panel program that helps potential solar technology adepts purchase solar equipment with 0% upfront costs. |

| Massachusetts | You can apply for the Solar Massachusetts Renewable Target (SMART) Program. This type of rebate for solar panels compensates you for the kilowatt-hour generated by your solar system. |

| Maryland | If you qualify for the Residential Clean Energy Rebate Program (R-CERP), you can obtain a $1,000 solar panel rebate for purchasing and installing a solar system. |

| Nevada | The state of Nevada offers NV Energy Residential Energy Storage Solar Incentives. They allow you to save money by installing a new at-home battery storage to a solar panel system. |

| New Hampshire | Residential Renewable Electrical Generation Government Solar Panel Program offers homeowners a financial compensation of up to $1,000. |

| New Jersey | New Jersey residents can apply for property tax incentives for solar panels. It functions as a property tax exemption on your home value. |

| New Mexico | The state supports the New Solar Market Development Income Tax Credit. It is a 10% solar tax rebate for home-based solar systems. |

| New York | The state of New York offers a 25% NY State Solar Energy System Equipment Tax Credit. |

| Pennsylvania | Local authorities support a government solar panel program offering a $200 solar rebate for a kilowatt of solar energy generated. |

| Rhode Island | You can use the Renewable Energy Fund (REF) to obtain solar incentives for small solar array systems. |

| South Carolina | The residents can benefit from a 25% South Carolina Solar Tax Credit. |

| Taxes | You can receive bill credits for any excess solar energy your system produces using solar incentives provided by TXU Energy Home Solar Buyback Plan. |

| Vermont | Solar panel owners can claim $10,500 toward a new home battery system with Green Mountain Power’s (GMP) Bring Your Own Device (BYOD) Government Solar Program. |

| Wisconsin | You can decrease your solar panel costs with the Energy Home Solar Rebate, which compensates you with a $500 solar panel rebate. |

Navigating the Landscape of Solar Incentives and Requirements

Solar incentives and government solar panel programs help business owners and individual households significantly reduce the upfront expenses associated with solar power usage. As a result, the widespread adoption of renewable solar energy becomes more attainable. Financial solar incentives encourage individuals, businesses, and non-profit organizations to invest in solar technology. With solar power rebates at hand, solar energy is becoming more economically viable.

Depending on your location and a solar array system, you can take advantage of various solar panel government programs, including solar tax exemption, solar rebates, solar panel federal tax credits, and more. Solar incentives and rebates ultimately make sustainable energy solutions more accessible and appealing.

Frequently Asked Questions

Can I claim an ITC if I rent my house?

Yes, the Federal Solar Tax Credit and other solar incentives are available for rental properties. However, you must reside in the property for a portion of the year minimum to become eligible for this government solar panel program. As a result, the percentage of your claim will depend on the time you spend in a rented house during the year.

Can I claim multiple tax incentives for solar panels?

You can claim both solar tax rebates and other state and local solar incentives. However, business owners can’t claim ITC and PTC simultaneously.

What states support the Net Metering solar incentives?

Almost all the states offer their residents the net metering program or other similar compensation initiatives. The up-to-date information on the net metering availability in your area is published on the DSIRE web page.

What state has the best solar incentives to offer?

According to the Old House, California is the number one US state to go solar in 2024. It has 72 government solar panel programs and other solar incentives and offers a reduced payback period of 4.7 years.