Do solar panels save money? In a way, they do. Investing in solar energy wouldn’t get more and more popular if it didn’t bring any solar savings, right?

Here, we need to ask the question differently. How much do solar panels save? And how long do solar panels take to pay for themselves? Briefly, it may take from 6 to 10 years depending on many factors like type of accommodation, state, etc.

In this blog post, we will shed light on solar investments and discuss various aspects of saving with solar. Additionally, we’ll calculate the ROI for solar panels. If you are interested in the “math” of such an investment, keep reading.

What Do Solar Investments Mean?

Let’s begin by discussing the initial investment required for purchasing and installing a solar system before we delve into its output or the solar panel payback period. This initial cost varies depending on the state and several other factors.

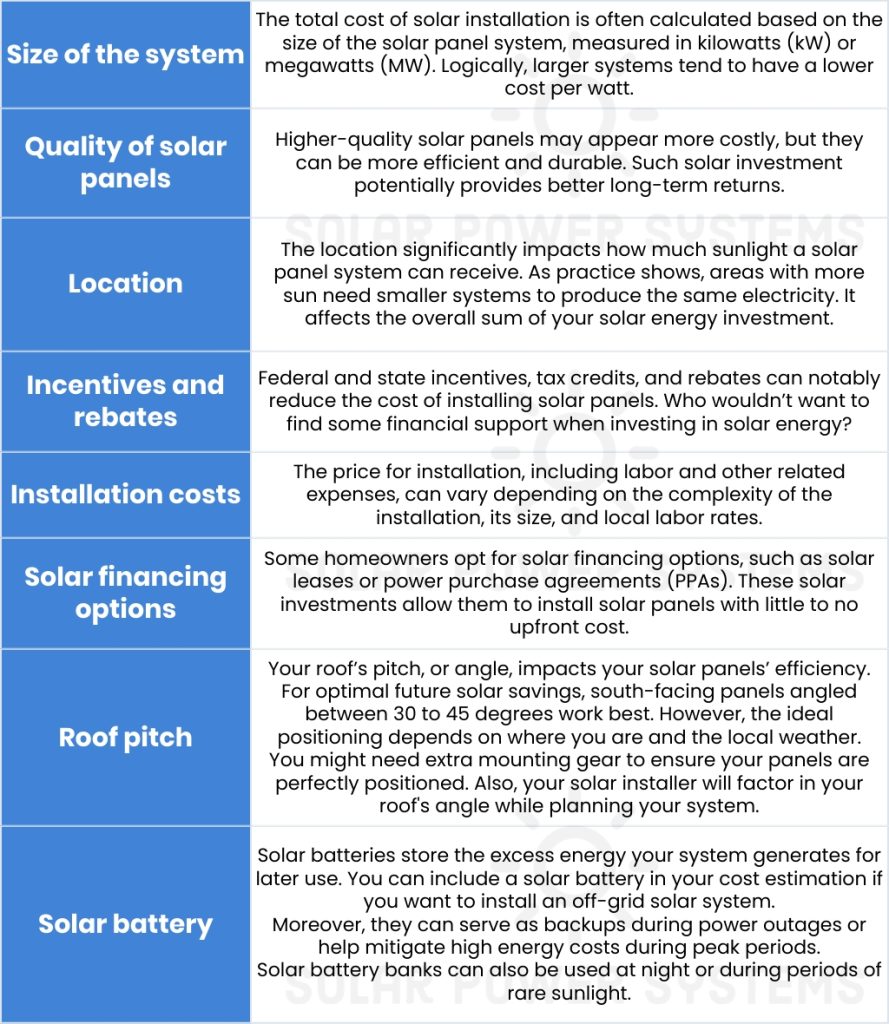

Here are some general cost considerations:

What Is Solar Payback?

Once you set out to research home solar panels, you’ll see the term “solar payback” or the solar panel payback period. These terms refer to a combination of the cost of solar panels, federal tax credits, and the energy consumption you’ve shifted to environmentally friendly sources.

The “solar panel payback period” is the time it’ll take for the solar savings on your energy bill to pay for the entire solar panel system. First years, you are saving with solar panels on your power bill until you break even. It means that you have returned the cost of solar panels over time. All the other solar savings add up to the pure income.

Average Solar Panel Payback Period in the U.S.

Though the average solar panel payback period is under 9 years, this can vary quite a bit from home to home. For some people, it may be as short as five years. For others, it may take as long as 15 years. As mentioned before, local electricity costs and state-specific financial incentives (tax credits, solar rebates, or net metering programs) are determinative factors.

Apart from that, the cost of the solar system itself varies.

What’s Considered a Good Payback Period for Solar Panels?

There is one way to determine whether you’re getting an excellent solar panel return on investment: you need to look at the entire lifespan of your system. Most residential solar systems last between 25 and 30 years. Let’s imagine that your solar panel payback period is 11 years. Then, you’ll be “making money” on the system for 14 to 29 years.

In general, if your solar panel payback period is less than half the life of your system, investing in solar energy is worth it. Depending on your investment strategies, solar panel installations may or may not offer a higher ROI than purchasing stocks, real estate, or other investments. It’s important to weigh IRR carefully to ensure the most prudent decision.

However, the best way to get an accurate assessment of your solar panel payback period is to connect with a local solar provider and request an estimate (if possible).

What Is the Average Solar Panel Payback Period for a Residential Solar Power System?

“How long do solar panels take to pay for themselves?”, a city dweller wonders. While the time it takes for your solar equipment to pay for itself varies, most people claim that their solar investments return during a period between 6 and 9 years.

Learning that high-quality solar panels are designed to serve their purpose over 25 years, you can understand why so many people view solar panels as financial investments. They are, indeed. If you spend some time and effort to find and apply for available net metering and government incentive programs, a solar power system becomes a significant money saver. Eventually, solar savings turn into a legitimate revenue stream for your family.

Calculating Solar Panel Payback Period: 5 Factors

5 primary notions are influencing your solar panel payback period:

| Average power consumption

(it determines how many solar panels you need) |

Total system cost without any incentives | Solar incentives, the federal tax credit, and the rebates | Energy production from your solar system | Electricity costs and the rate of increase |

We’ve delved into each of these factors to provide a comprehensive understanding of the numerical aspects. To illustrate, we’ve taken a house in Colorado as an example to demonstrate the figures.

Factor 1. Average Power Consumption For Your Home

First and foremost, you need to determine how big your solar panel system should be. It’s the most defining factor of calculating a solar panel payback period. To do that, you need to identify your average electricity usage. Then, design a solar system that produces enough energy to balance out that usage for the year.

Let’s imagine that our example home uses about 9,500 kilowatt-hours (kWh) of electricity annually. According to the PVWatts Calculator, one kilowatt (kW) of solar panels in Lakeside, CO can generate around 1,575 kWh per year. The next thing you need to do is to divide 9,500 by 1,575, and you get a system size of about 6 kW.

Factor 2. Total System Cost Without Any Incentives

The next important step toward saving with solar involves calculating the total cost of your solar system without any incentives. The number will show the ultimate expense of the solar investment before any deductions. This value is the baseline for deducting potential solar savings and establishing the payback period.

Feeling bewildered? Let’s do some calculations with approximate numbers so that you get an idea of what to expect when investing in solar energy.

For instance, as of October 2023, the average cost across the country for a 6 kW residential solar system was approximately $2.95 per watt, totaling $17,700 without counting any incentives. In this case, the homeowner must either make a cash payment or secure a solar loan for roughly this amount.

As we have the total cost now, let’s see whether there are any possibilities to lower it somehow.

Factor 3. Solar Incentives, The Federal Tax Credit, and Rebates

How do solar panels save money? You pay a lower tax bill. Plus, you not only contribute to environmental sustainability but also receive a big tax benefit in the first year. The federal solar tax credit allows you to claim 30% of the total installation costs.

Almost all states offer additional solar incentives such as rebates and performance-based motivators. If you deduct the monetary value of these incentives from the total system cost, you can calculate the net cost of solar panels.

For instance, consider our Lakeside dweller who benefits from generous sunlight despite many associating Colorado with snowy weather. Locals get as much sun as others in states like Mississippi, Louisiana, Texas, and Alabama.

With a previously estimated cost of $17,700, the 6-kW solar system qualifies for a tax credit of $5,310. It means that the net cost of the system is $12,390. Now, consider the deduction of future energy bill savings resulting from your solar energy investment.

Factor 4. Energy Production From Your Solar System

Once you know your solar system size, you can do the following:

- Multiply the capacity of your solar panels in kilowatts (kW) under full sun by the annual kilowatt-hours (kWh) produced by 1 kW

- Multiply the result by the cost per kWh charged by your utility

For example, as mentioned above, each kW of solar panels in Lakeside generates an average of 1,575 kWh of electricity annually. By multiplying this figure by the 6 kW system size, our city dweller can expect their solar panels to produce approximately 9,450 kWh annually.

Factor 5. Electricity Costs And Rate Of Increase

Here’s another critical moment. In a state with net metering, you can take the number of kWh your system will produce in a year and multiply it by your per-kWh rate from the utility. That number will represent your annual solar savings from your solar investments.

If you need a straightforward saving formula, just divide the net cost (Factor 3) by your average annual solar savings to get the number of years it will take for your solar savings to equal the net cost of the system (in other words, you will calculate a solar panel payback period).

In Colorado, the net metering regulation is straightforward. It ensures that the utility credits every kWh of solar electricity sent to the grid at a 1-to-1 rate. Considering Xcel’s cost of approximately $0.143 per kWh, the 9,450 kWh solar production would translate to solar savings of about $1,350 per year. Then, if we divide a solar system’s net cost ($12,390) by the number of annual solar savings ($1,350), it will give a solar payback period of about 9.2 years. This number excludes possible electric rate increases between now and then.

12,390 (÷) 1,350 = 9.2

For example, assuming the solar panels are fully installed by July 2024, they would be fully paid off before the holidays of 2034 and continue generating electricity until at least 2049. This result is undoubtedly a beneficial deal.

Once you have all the necessary solar investment data, you can use a solar payback calculator to get the period it takes for solar panels to pay for themselves.

However, the solar payback period can be even shorter if you use up to 70% of electricity generated by solar panels, and the rest is sold into the grid due to net metering programs.

The Electricity Rates Increase Over Time

Predicting the rate of increase in electricity costs is the most challenging in all calculations of the solar panel payback period.

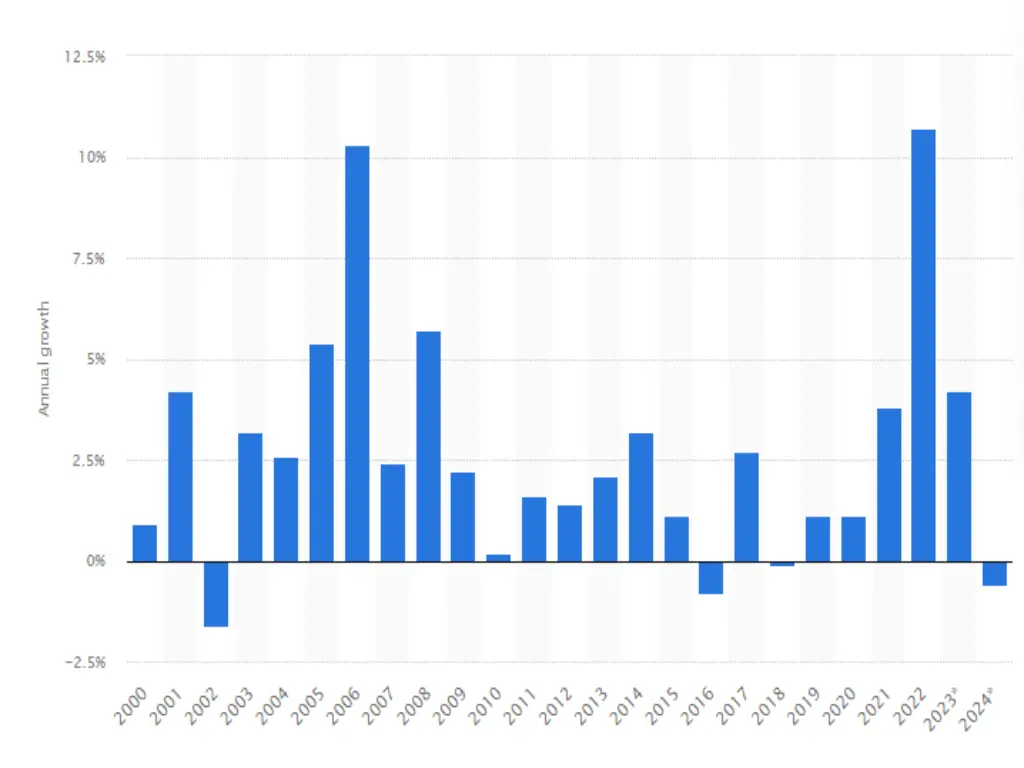

In Statista’s chart below, you may see that retail residential electricity prices in the United States have mostly risen over the last decades. Residential prices are projected to rise further, growing by four percent in 2023, when compared to the previous year.

Source: Statista

How To Calculate ROI For Solar Investments

Now that you’re familiar with the solar payback period, you’ll get introduced to another term — return on investment (ROI). This is a popular profitability metric used to evaluate how well an investment has performed. There are 2 crucial things to know:

- ROI is typically expressed as a percentage because it is intuitively easier to understand than a ratio.

- The ROI calculation includes the net return in the numerator because returns from an investment can be either positive or negative.

Once the solar panel payback period ends, you start profiting from your purchase.

Here’s the deal: solar return on investment (ROI) isn’t the same as payback time. Figuring out how long it takes for solar panels to pay for themselves is just one side of the story. The other part is about the expected return rate. To get that, you look at the average savings your solar system will bring in over its lifetime.

To calculate the ROI of solar panels, you need to compare the net installation cost after one-time incentives with expected electric bill savings and ongoing rewards over time.

Here are several key factors impacting the ROI for solar panels:

- Average power consumption

- Local solar incentives and rebates

- Total cost of solar system installation

- Cost of maintenance and upkeep

As you may see, factors impacting the payback period coincide with the ones impacting the ROI of a solar investment. For using a solar ROI calculator, you need to add all these things together to get an exact sum of money that constitutes the cost of your solar investment.

There are many available solar ROI calculators online. They give you the answer after you put your data there.

Other Ways To Benefit From Your Solar Savings

Investing in solar energy has proved to be beneficial with time. For those wanting to maximize their smart solar investment, let’s explore some strategies for utilizing more of the solar energy you generate at no cost.

Location Matters

Living in the southern part of the country can increase your solar output by up to five percent compared to the north. Your location within the US significantly influences how much solar energy you produce and use, affecting how quickly your system pays for itself.

The more south you go, the more sunlight your panels receive. Southern states typically get around 10% more energy compared to northern states.

Staying Home At Daytime

If you work remotely, you can also expect better solar savings. Simply being home in the daytime means you’re using more of that free energy. Consequently, the more solar energy you consume, the more you save on your electricity bills.

Being at home all day means you might not have extra energy to sell back to the grid. Yet, with energy costs going up, what you’d earn from selling solar energy could be less than what you save by not paying your energy provider. Using solar energy yourself turns out to be more beneficial than selling it.

Also, try using your appliances during the day whenever you can. For example, if you leave for work, run the dishwasher in the morning and set your washing machine for the afternoon. These small actions significantly contribute to your solar savings.

If you want to consume even more of the electricity than you generate, it’s worth considering investing in a solar battery.

Understanding Solar Investments: Grid-Tied and Off-Grid Considerations

Off-grid factors differ a little. Batteries turn into a considerable expense that also requires replacement over the system’s lifespan. Whether solar panel installation provides a higher return on investment (ROI) than real estate or stocks depends on your investment strategy. Use the solar ROI calculator for precise figures.

Investing in solar energy proves advantageous, especially when connected to the grid, reducing energy storage costs. DIY grid-tied systems typically recoup expenses within five years, while contractor-installed systems may take 8 to 10 years. Considering solar panels last 25 years, the long-term savings are substantial.