Solar panels are becoming more and more popular in the US due to the obvious advantages of renewable energy sources. Today, the United States is one of the largest users of solar energy: data from the National Renewable Energy Laboratory (NREL) indicates the capacity of community solar installations has grown rapidly since 2016 (not taking into account industrial solar panel installations). In 2021, over 2 GWac were installed, the greatest annual installation amount to date. As a result, in 2022, 45% of the newly added capacity for producing power came from solar energy.

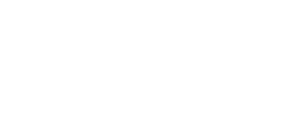

Why is that? First of all, there is the constant growth of the electricity rates in the US: the average price for the kilowatt rose from 13.15 cents in 2020 to 15.12 cents in 2022 – almost 15% growth in two years!

Source: Statista

Secondly, local governments provide tax refunds and other financial incentives to install solar panels. And combined with a stable financial and banking system we have this prominent result – 3.6 million solar panel installations in 2022.

At the same time, for many households, the start-up costs ranging from $16,000 to $41,000 (before the federal tax credit) may be an obstacle. Here’s where solar leasing becomes important. Solar panel companies install solar panels on homes, and homeowners can start going green by leasing solar panels. Let’s take a closer look at the pros and cons of leasing solar panels.

So, let’s go through how solar leases work.

Source: EcoWatch

What Is Solar Lease and How It Differs From Loan

In general, leasing solar panels is a financial instrument that allows you to get the solar panels without immediately emptying your bank account. The solar company installs and maintains the solar panels, and in return, the homeowner pays a fixed monthly lease of $50-250 for a specified lease term, usually ranging from 15 to 25 years. After the installation, you can use the energy you produced for your living or store it in the backup battery.

What does leasing solar panels make different from the loan? The main difference is that the homeowner who buys the solar panels with the loan becomes the owner of the panels. Meanwhile, with solar leasing, the solar provider keeps ownership of the panels during the lease term. However, some lease agreements may offer the option to purchase the system at the end of the solar lease period.

Below, we are going through several types of solar lease plans.

Types of Solar Lease in the USA

There are different types of solar leases. Here, we will discuss three major ones with different leasing rates and diverse costs of leasing solar panels.

Operating Solar Lease

This type of solar panel lease focuses on short-term benefits with the option to upgrade technology. Unlike a loan or a Power Purchase Agreement (PPA) (see below), where there is a focus on eventual ownership, operating solar lease is more short-term and often offer flexibility for the solar panel lessee.

Key features of operating leases for solar panels:

- Short-term: operating solar leases focus on a shorter duration compared to other solar financing options. They often range from 7 to 15 years.

- No ownership at the end: at the end of the solar lease term, the lessee does not own the solar panel system. Instead, they may have the option to renew the solar lease, upgrade to a newer system, or purchase the system at fair market value.

- Maintenance and repairs: just like with other types of solar leases, in an operating solar lease, the responsibility for maintenance and repairs lies with the solar service provider. This can be an attractive feature for those who prefer to cut off all the pains and concerns of spending time and money cleaning the panels and keeping an eye on them.

- Flexibility to upgrade: operating a solar lease often provides the lessee with the option to upgrade to newer and more efficient solar technology during or at the end of the solar lease term. This option allows you to stay with up-to-date solar systems and always use new technologies.

- Monthly lease payments: the lessee makes fixed monthly lease payments to the solar service provider. These payments typically include the cost of the system, maintenance, and any additional services provided.

Here is a rough calculation of the solar lease plan given the price of the 6kWp solar panel system, which costs $ 17,700, the operating solar lease term is 10 years, and the annual interest rate is 5%.

| Lease term | Annual interest rate | Monthly lease | Final leasing cost |

| 10 years | 5% | $198.26 | $23,791 |

Capital Solar Lease

This is almost like a loan that lets homeowners own the solar panel system after a set period. If the homeowner wants to own the solar panel system at the end of the solar lease term, they choose a capital solar lease. The monthly lease payment also includes both interest and principal, with the goal of transferring ownership to the lessee at the end of the solar lease term.

Key features of capital solar lease for solar panels:

- Ownership transfer: unlike an operating solar lease, the goal of a capital solar lease is to transfer ownership of the solar panel system to the lessee at the end of the solar lease term. This typically involves a nominal purchase option, such as $1.

- Longer-term obligation: capital solar lease often have longer terms compared to operating solar lease. Terms can range from 10 to 20 years.

- Depreciation and tax benefits: the lessee may be eligible for tax benefits, including the ability to depreciate the solar panel system over its useful life. This can result in potential tax savings for the lessee.

- Maintenance responsibility: the lessee, not the solar company, is responsible for the maintenance and upkeep of the solar panel system during the solar lease term. That makes sense ‘cause if you want to own the solar panels at the end of the lease term, you really want to keep the solar system up and running.

Check this rough calculation rough calculation how much is a solar lease per month and what the final lease solar panels cost, considering a 5% annual interest rate.

| Solar lease term | Annual interest rate | Monthly lease | Final leasing cost |

| 15years | 5% | $149.52 | $26 906 |

Power Purchase Agreements (PPAs)

It’s like the electrical company would bring a small power plant into every house and sell electricity directly to the customer. How does that work? Read the next paragraph.

Source: Energy theory

Be honest – every month, you think about how to jump off the electrical grid and become truly independent. And that could be with solar panel leasing.

With Power Purchase Agreement (PPA) any household can pay the solar company not for the solar panels, but for the electricity.

How it works?

- Solar provider installs and owns the solar panels on a customer’s property.

- The solar panels generate electricity, and the customer agrees to purchase the power generated by the panels at a predetermined rate.

- The electricity generated by the solar panels offsets the customer’s reliance on the traditional electrical grid.

In this way, a PPA can significantly reduce electricity bills and decrease dependence on grid-supplied power during daylight hours. So, instead of owning the solar panels, the customer enters into a long-term agreement to buy the electricity generated by the panels. The rates are often fixed or may have predetermined increases, providing some stability in energy costs.

It sounds like an escape from the traditional electricity bills, and PPA can reduce dependence on the grid during daylight hours. But it doesn’t typically replace the grid entirely. Here are a few reasons why:

- Irregular Power Generation: solar power generation depends on sunlight. At night or during cloudy days, the solar panels won’t produce power, and the grid serves as a reliable backup.

- Energy Storage: without energy storage solutions like solar batteries, extra energy generated during sunny periods won’t be used during non-generating periods.

- Complex Energy Systems for Households: achieving complete independence from the grid would require a combination of solar panels, energy storage, and potential backup generators. This will require hiring experts (or spending your own time on research) and will add additional costs of purchasing extra equipment.

Generally speaking, while a Power Purchase Agreement significantly reduces reliance on the electrical grid and can provide substantial cost savings, it typically complements the grid rather than serving as a complete substitute. Homeowners or businesses looking for more autonomy may explore integrated solutions that include solar panels, energy storage and solar batteries, and backup generation systems.

How Much Does Solar Panel Lease Cost?

An average solar panel system installed in the US has a 6.0 kWp and costs about $17,700 (before federal tax credit).

Here is the rough calculation of how much a solar lease is per month and the final leasing solar panels cost, considering a 5% annual interest rate.

| Lease plan | Annual interest rate | Monthly lease | Final leasing cost |

| 20 years | 5% | $123.48 | $29,635 |

| 15 years | 5% | $145.37 | $26,167 |

As you can see, the shorter the lease period, the lower your final leasing cost is.

The average house in the US uses about 11,703 kWh of energy per year, and the average electricity price in 2022 was 15.12 cents per kW. So, the annual electricity costs are $1769, which equals $35 380 in 20 years (if the electricity cost will be fixed during these years).

So, to make the lease deal efficient, the solar panel system has to cover more than 70% of the household’s energy consumption. Is that technically possible? Yes, if you are ready to spend extra money on solar batteries.

Is It Possible To Sell a House With a Solar Panel Lease?

Stuff happens during your lifetime, and you may want to sell a house. And how does the solar lease influence you? Here are several things you need to consider before sealing the solar lease deal.

- Transferability of the solar lease: not all potential buyers may be interested in accepting the existing solar lease. Even if they do, the terms of transferability vary among solar leasing companies. Some may allow easy transfer, while others may have more strict conditions: the solar leasing company may conduct a credit check on the new homeowner who wishes to accept the solar lease. If the new owner does not meet the credit requirements, this could complicate the transfer process.

- Home value: in general, solar panels add some market value to the house, but the solar lease may play an opposite depreciative role. Some potential buyers might not be interested in buying a house with additional monthly payments. Especially if the solar lease has many years left, potential buyers may need to think twice before making the long-term commitment. Or they may prefer a specific solar technology.

- Solar lease buyout options: solar leasing companies may offer buyout options, allowing the homeowner to purchase the system or transfer the solar lease to a new property. However, the buyout cost might be an issue and ruin your plan to get a certain amount of money for your house.

- Home sale timing: selling the house with a solar lease will definitely take more time. So, make your lifetime plans accordingly.

Source: Berkley Lab

Leasing Solar Panels Pros and Cons

So, you already know how solar leases work, what the types of solar leases are, how big the monthly lease rates are, what the solar panels cost is, and what the final cost of leasing solar panels is. Let’s sum up all the information into the pros and cons of leasing solar panels

Pros of Leasing Solar Panels

- Low upfront cost: solar panel lease eliminates the need for upfront cost, making solar energy accessible to a wider range of people. With installation costs averaging around $ 17.700 for residential solar panels, the ability to bypass this financial barrier is an important advantage.

- Maintenance included: the leasing company is responsible for the repairs and upkeep of the solar system because they are the owners, and they want their stuff to be in the proper condition. If you have purchased the solar panels with the loan, you should add the maintenance costs to your monthly loan bills.

- Immediate savings: homeowners can save on their electricity bills right away. As they generate solar power, they take less electricity form the which leads to reduced monthly utility costs.

Cons of Leasing Solar Panels

- Long-term costs: over the solar lease period, the final cost of leasing solar panels may exceed the cost of purchasing a system outright. While the upfront cost is low, the total amount paid over the solar lease term might be higher than the cost of a purchased system. Homeowners should evaluate the immediate financial relief against the long-term expenditure.

- Limited tax incentives: solar leasing may not qualify for certain tax credits and incentives available to solar system owners. Federal tax credits, which can significantly reduce the overall cost of purchasing solar panels, might not be applicable to solar leasing. This can impact the overall financial benefits associated with solar adoption.

- No ownership benefits: homeowners who lease miss out on potential benefits associated with solar panel ownership. These include the potential for increased home value, as solar-equipped homes are often considered more attractive in the real estate market. Additionally, owners can benefit from federal tax credits, further reducing the overall cost of solar panel installation.

Source: ISG

Solar Lease or Not?

To put it simply, solar leasing may be compared to an inexpensive ticket to the renewable energy celebration. For those who want to become green without having to shell out a ton of money upfront, it’s a great alternative. Well, things aren’t always sunshine and rainbows. The transfer of your solar lease may seem like a conundrum when it comes time to sell your home. While some purchasers could throw caution to the wind, others might go all in.

Solar leasing does, however, come with advantages. Updated with the newest solar technology? Check. Not a single maintenance headache? Check again. You also get to preserve the planet without having to buy the whole solar system. Win-win, isn’t that right?

But make sure you read the agreement before getting started with the solar leasing. It’s all in the details, people. Consider what would happen if you decided to relocate and wanted to save those panels in the event that you have to bail early. There is plenty to think about.

Ultimately, it is up to you. Solar leasing can be your best option if you’re all about protecting the environment and your money at the same time. However, that’s a different story if you’re hoping to get completely off the grid and possess your own solar system. Make sure you are happy with the conditions of the lease by speaking with the solar specialists before making your decision. Happy solar vibes to you! ?