Are you considering adopting solar power solutions to equip your household with alternative electricity sources? Like many other homeowners worldwide, the hefty upfront investment required to get started with renewable energy is a major challenge. Luckily, nowadays, policymakers offer solar incentives and solar panel rebate programs to reduce operation costs so you can make a budget.

We offer you a thorough comparison of government programs for solar panels, including solar power rebates and tax incentives. Keep reading about what solar power programs you are eligible for, how to apply, and how to boost your solar panel return on investment.

Government Incentives for Solar Panels: Explained

The idea of solar incentives is based on a simple premise — the reduced cost of solar technology will encourage more people to adopt it. In such a way, government and local authorities support environmental protection, ensure a more resilient energy grid, and lower electricity bills for citizens.

Solar incentives are an umbrella term covering multiple government solar programs. They include various subsidies for solar array owners.

Let’s review the most common forms of solar incentives available nowadays.

| Solar panel incentives | The government incentivizes homeowners or businesses to encourage prompt implementation of solar energy systems. |

| Solar power rebates | The government or utility agencies typically support one-time compensations for solar array installation. Such solar incentives usually reduce the upfront expenses connected with solar panel installation. |

| Solar energy tax credit | A direct deduction from your income taxes paid to a federal government. |

| Utility rebates | Utility agencies can refund cash to homeowners as a solar panel rebate to encourage solar technology usage. |

| Performance-based payments | These solar incentives allow solar panel owners to generate extra income using their household’s solar energy. |

The Federal Solar Tax Credit

Solar energy tax credits are solar incentives with fiscal tools. They help decrease your taxable income and directly influence how big your annual tax bill is. It works as a dollar-for-dollar reduction of the income tax you owe.

The installation of solar panels qualifies you for a federal tax credit. In other words, you’ll obtain credit for your income taxes, which will help you reduce your tax bill.

The federal government released the Solar Investment Tax Credit (ITC) in 2006. Since then, solar power usage in the USA has demonstrated stunning growth. Over the last ten years, the average annual increase was 50%. This type of tax incentives for solar panel owners started at 26% and reached 30% in 2024.

Let’s dive into the qualification criteria households and businesses must meet to utilize federal solar incentives.

What Does the Federal Solar Energy Tax Credit Cover?

All solar-equipped households with recently installed solar systems can claim a federal tax credit. In 2024, these solar incentives cover 30% of the following:

- Solar panel system costs

- Other solar equipment and devices (inverters, wiring, and mounting hardware)

- Solar array installation expenses, including obtaining necessary permits and inspecting the property

- Solar energy storage equipment (e.g., solar batteries) with 3 kilowatt-hours (kWh) capacity and more

Federal Solar Tax Credit Eligibility Criteria

To be eligible for the solar energy tax credit, the dollar panel system installed should meet specific requirements.

| Ownership type | You must own your solar panel systems through a direct purchase. Solar arrays bought via solar lease will not qualify. |

| Solar panel system location | You must use a solar system in the USA and reside on the property where solar panels operate. Rental houses are not eligible for this type of solar incentive. |

| Installation originality | To apply for a federal solar tax credit, you must install brand-new solar equipment. If you remove it and reinstall it in another location, you can’t claim solar incentives anymore. |

The type of solar system equipment is another factor influencing whether you can apply for federal tax incentives for solar energy. Regarding solar system installation, you can use two different devices to benefit from sun-generated electricity.

These can be solar water heaters and solar photovoltaic systems:

| Solar water heaters | PV systems |

| These devices ensure water generation at a reduced price. They come in various designs, including solar collectors and storage tanks. | PV panels, often called solar panels, are typically installed on the roof of your property. They generate electricity by absorbing and converting sunlight particles. |

State-Based Solar Tax Incentives

Solar panel rebate programs and solar energy incentives vary from one state to another. Local governments and utility companies can also influence what solar power programs you can apply for.

Let’s check some of the tax incentives for solar system owners. They include federal tax incentives and state programs for qualifying taxpayers. A solar energy tax credit decreases your income tax liability and may support tax exemption incentives. Your eligibility for these solar incentives depends on your location.

State Tax Credits

Many local authorities provide solar tax credits that carry a similar function to the federal solar tax credit. Regardless of the state, state policymakers introduce them to lower the cost of solar systems.

For instance, in California, you can apply for a Solar Energy System Property Tax Exemption that prevents the increase in a property’s assessed value after solar system installation.

Production Tax Credit (PTC)

This government solar program only exists for industrial solar panel owners. Suppose you run a business and utilize solar energy. In that case, you are eligible for solar incentives in the form of a tax credit for every kilowatt-hour of electricity your solar array generates.

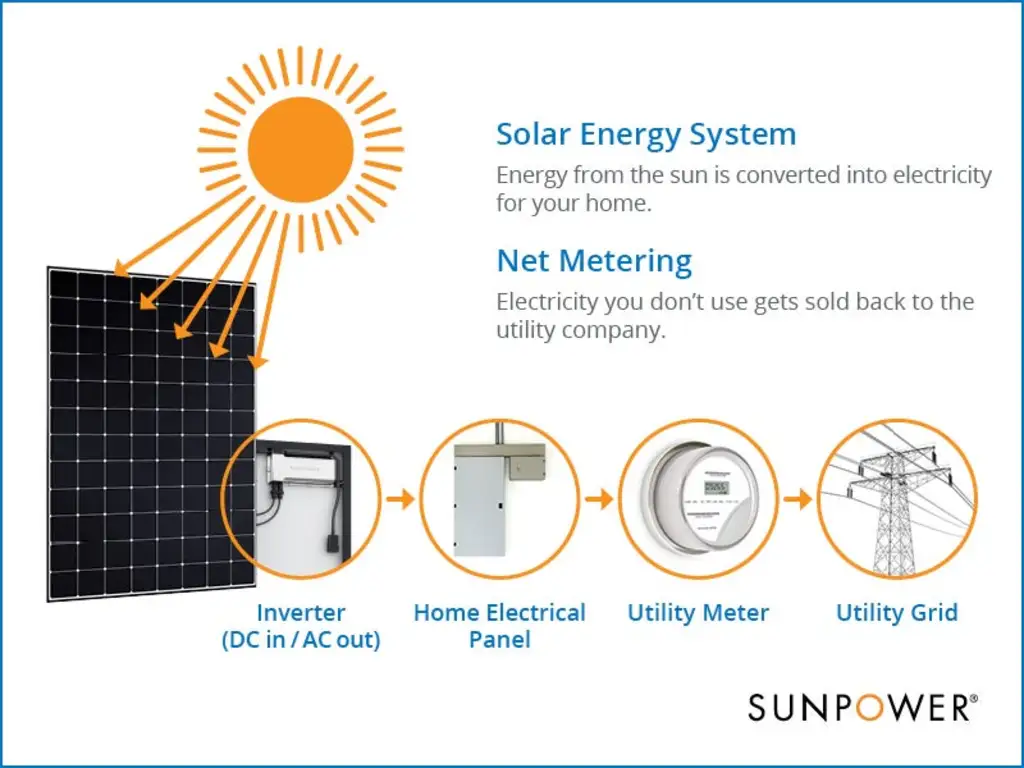

The Net Metering Program

The Net Metering Program, or NEM, offers solar incentives allowing private solar panel owners to sell excess energy they generate to the national electric grid. Not only does it allow people who use solar arrays to save up some money, but it also has environmental benefits and reduces the electric grid demand.

Net metering, a government incentive for solar energy, allows you to utilize saved energy from your solar batteries and share it with the community.

Yet, many homeowners must grasp the mechanics of these solar incentives. The key lies in the fact that it doesn’t offer a direct cash reimbursement for solar energy. The process involves initially sending power to the electric company, causing your electric meter to run backward. Consequently, you may experience considerably reduced electric bills or even eliminate them.

Key Principles of Net Metering Solar Incentives:

You must be connected to the local grid to benefit from the net metering government solar program. It is because even efficient solar energy systems can’t generate electricity continually. Night hours and unfavorable weather conditions decrease your solar panel system performance, and you may need to supplement your electricity with electricity from the grid.

On the other hand, net metering solar incentives allow you to trade excess electricity to the grid during peak hours. For instance, if you sell electricity to the grid at $10 during daylight hours and then draw electricity from the grid at a $12 rate during nighttime, your total electricity bill for the day could be as low as $2.

Net Metering Solar Incentives: Pros and Cons

One of the major advantages of net metering solar incentives is their money-saving potential. However, it is not free from certain drawbacks. Let’s discuss both to determine whether the program suits your household.

| The Net Metering Program | |

|---|---|

| Pros | Cons |

| You become less dependent on the grid and contribute to making it more eco-friendly. | The program benefits only homeowners who connect their households to the local grid. |

| You become more mindful about your utility bills and control energy consumption better. | Some states don’t support the net metering solar incentives. |

| You can reduce the solar panel system payback period by generating extra income using net metering solar incentives. | You don’t receive financial compensation for transferring electricity to the grid. Instead, your electricity bills get reduced. |

How To Get Started With Net Metering Solar Incentives

For homeowners interested in applying for net metering to reduce the costs spent on utility bills, the first step is checking whether your state supports such solar incentives. In 2024, 38 states, including Washington, D.C., allow solar panel owners to join the program. Even in states that do not support net metering, some major utility providers still offer the option to clients.

The best way to learn more about your state’s policies on net metering is to reach out directly to the solar company you want to use. Using net metering solar incentives should be easy once they install solar arrays on your property and connect you to the grid.

Source: SunPower

Essential Insights into Solar Panel Rebate Programs

Government incentives for solar panels also come as rebates. Solar system owners can lower their expenses by 10-20% using such solar incentives. However, they are typically available temporarily until a certain amount of solar arrays start functioning in your region.

A solar panel rebate often requires you to put up with an intricate application process. On the other hand, a considerable financial gain makes it well worth the time spent.

Applying for a state or utility solar panel rebate program, you may have to deal with certain restrictions on the solar equipment type, solar panel size requirements, or whether solar panel installer companies are eligible. For example, the installer you choose should obtain specific licensing and certification.

Because of these requirements, going with a state or utility rebate often implies submitting detailed information about:

- Your solar array system design

- Performance expectations

- Project expenses

- Solar installer

More often than not, your solar panel installation company will apply for a solar panel rebate on your behalf or walk you through the process. Remember that your local government sometimes doesn’t pay solar power rebates directly. They may transfer the refund to your installation company. The installer will later deduct the solar incentives from your total installation price.

You may come across two types of solar panel rebate options. Keep reading to find out more about the specifics of each.

Solar Panel Rebate Programs Provided by Installers

Some solar panel installation companies offer seasonal solar power rebates and other promotional campaigns limited in time. Such solar panel rebate programs encourage customers to purchase a specific installer.

If this applies to your solar panel provider, all you have to do is sign the contract. This means you won’t have to go through the hassle of completing the solar panel rebate application. Instead, the solar panel installer will deduct the rebate from the installation costs.

Solar Panel Rebate Programs Provided by Manufacturers

Solar installers and manufacturers now offer solar panel rebate options for homeowners choosing their products. If your solar panel company has such a promotion, apply directly on their website. Remember that solar system manufacturers may require installation proof, such as a signed contract and/or a statement from your utility company confirming your system is in use.

Performance-Based Solar Incentives (PBIs)

A Performance-Based Incentive is a form of financial compensation that relies on a solar array system’s real-time electricity output. These solar incentives use an energy-based metric ($/kWh) over a set time.

In contrast to a traditional approach of paying out a one-time solar panel rebate, PBI uses a per-kilowatt ($/kW) basis upon solar panel installation.

How Do PBIs Function?

Performance-based solar incentives implement the metering technology to determine the energy output of a given solar panel system. This data is later transferred to the program administrator.

Using the California Solar Initiative as an example, let’s analyze how PBI works. This government solar program includes monthly distribution of payments over five years and equals 60 payments in total. This reimbursement depends on the energy production of the solar panel system and is measured in kilowatt-hours (kWh).

Why Are PBIs Important to Solar Energy?

These solar panel incentives offer a direct financial stimulus and encourage consumers to adopt solar panel technology. Additionally, since PBIs depend on the energy system’s output, they make solar panel owners more aware of proper solar system installation, regular maintenance, and how they can ensure optimal performance.

Another essential role PBIs perform is facilitating the fair distribution of solar incentives. They prevent installers and solar panel owners from improperly benefiting from solar panel subsidies. As a result, it supports further solar energy adoption.

Other Solar Incentives and Solar Panel Rebate Options

There are some less popular solar panel incentives. However, many potential solar panel owners may find considerable financial benefits from these solar power programs.

Solar System Subsidized Loans

This government solar program allows homeowners and enterprises to finance their solar systems at a decreased interest rate. However, these solar incentives are time-limited, so you should consult a solar panel system installer to check what solar power programs you can apply for.

Solar Renewable Energy Certificates (SRECs)

This form of government incentives for solar panels is available in limited states. Relevant authorities monitor the energy produced by your solar panel system, and they determine whether you can obtain SRECs based on solar generation rates. The financial reimbursement you receive using such solar incentives is taxable.

Local Utility Rebates

Homeowners in many states can apply for financial solar incentives from local utility companies. These incentives are designed to motivate homeowners to embrace solar power systems for their residences. Some offer solar panel rebates on your monthly electricity bills, considering how much energy you generate. Others can provide you with one-time subsidies for solar panel system installation.

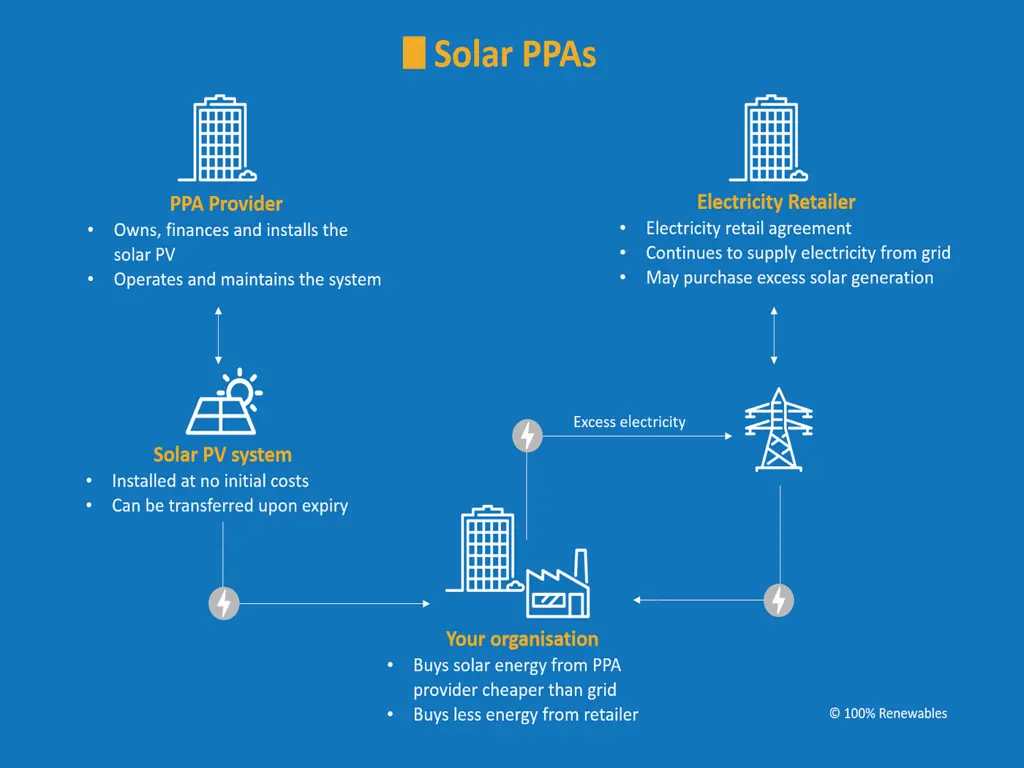

Solar PPA

A Solar Power Purchase Agreement, or PPA, is a solar incentive that implies a specific type of solar lease. You have a right to use a solar panel system without owning it. Additionally, PPA users carry no responsibility for the panels. Solar arrays belong to the company which installs and maintains them.

What is the profit for a solar installer, then? The installation company charges a solar panel user for the electricity generated by their solar panels. While the homeowner pays a lower rate for the electricity compared to the grid, if the solar panels don’t fully meet the household’s electrical needs, the homeowner may need to pay extra to the utility company.

Source: Medium

Solar Loan

Solar panel loans are no different from other loans. If you apply for these solar incentives, a lender provides you with money to pay for solar panel installation. Then, you make monthly payments until you pay off the loan.

Regarding interest rates, expect to pay anything from 4% to 7%.

The total cost of solar panels installed via solar loan depends on several factors:

- Tax rates

- Term length

- Fees

Most solar loans are fixed-rate, which means you will pay a fixed interest rate throughout the loan’s duration. The longer the term of your solar loan, the lower your monthly payments will be.

What Are the Best States for Solar Energy Users?

Choosing solar energy is undoubtedly a good investment for homeowners nationwide. Still, some states make investing in a solar system even more lucrative than others, offering many solar incentives to choose from.

Continue reading to learn more about the states that offer the most favorable conditions for solar-equipped households.

| State | Solar Incentives Available |

| New York |

|

| Iowa |

|

| Rhode Island |

|

| Maryland |

|

| Connecticut |

|

Should You Go Solar in 2024?

The transition to renewable energy sources, including solar power, is inevitable. Although solar panel installation requires an upfront payment not all homeowners can afford, they remain a cost-effective energy solution. The sooner you go solar, the sooner you save on monthly electricity bills.

If solar panel installation prices are holding you back from adopting solar technology, you can benefit from federal incentives for solar panels. Solar tax incentives will remain available for around ten years. In addition, numerous solar panel rebates, government solar programs, and other solar incentives help make solar power adoption easier for residents and business owners.

Frequently Asked Questions

What is the federal solar energy tax credit in 2024?

This year, the federal solar tax credit will equal 30% of your solar panel system value. You can claim the credit on your annual income tax return and reduce the taxes you pay.

What solar incentives and solar panel rebate programs are available in my state?

You can consult a Database of State Incentives for Renewables & Efficiency. It contains a detailed list of solar incentives by state and more information on solar policies across the country.

What is the difference between a solar loan and a PPA?

These two solar panel incentives differ based on the ownership type. With PPA, you never own solar panel systems. Solar loans imply that you own solar equipment by paying monthly for it.